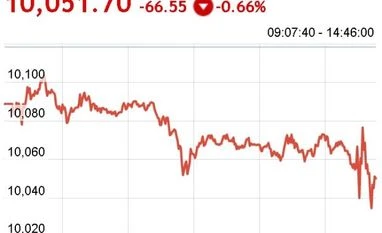

Sensex ends 205 pts lower, Nifty below 10050 post RBI policy outcome

Here's all that happened in the market today

)

Source: NSE

The benchmark indices ended lower on Wednesday as the Reserve Bank of India kept repo rate unchanged at 6%.

The reverse repo rate under the LAF remained at 5.75%, and the marginal standing facility (MSF) rate and the bank rate at 6.25%.

RBI maintained a neutral stance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4% within a band of +/- 2 per cent, while supporting growth.

The Central Bank retained economic growth projection for 2017-18 at 6.7% saying that the risks are evenly balanced.

In its Fifth Bi-monthly Monetary Policy Statement, 2017- 18, RBI said that the second quarter growth was lower than the one that was projected in the October review, and the recent increase in oil prices may have a negative impact on margins of firms and Gross Value Added (GVA) growth.

In August, the RBI made its only cut in 2017, of 25 basis points, and in October, it held.

Globally, Asian stocks slipped across the board on Wednesday as various factors including weaker metals prices and monetary policy concerns in China soured investor risk sentiment. The fall in the index deepened as Asia's equity markets suffered losses, with Shanghai stocks falling to three-month lows and Hong Kong's Hang Seng dropping to a one-month trough amid fears over central banks tightening liquidity.

Globally, Asian stocks slipped across the board on Wednesday as various factors including weaker metals prices and monetary policy concerns in China soured investor risk sentiment. The fall in the index deepened as Asia's equity markets suffered losses, with Shanghai stocks falling to three-month lows and Hong Kong's Hang Seng dropping to a one-month trough amid fears over central banks tightening liquidity.

4:21 PM

Radhika Rao, India Economist, DBS Bank on RBI policy

The guidance was cautious on the near-term inflation outlook, owing to higher oil prices, housing rent allowance increases, rising input prices, fiscal slippage risks and core pressures. However, this was counter-balanced by a negative output gap and the cuts in GST rates which are expected to partly ease price pressures. While the FY18 GVA estimate was maintained and growth has bottomed-out in 2Q, a downward revision remains on the cards.

Back on inflation, we expect the headline to settle within a broad 4-5% range, with base effects tempering the headline prints intermittently. While this closes the door for rate cuts, a clear bias towards rate hikes will require faster inflation to be accompanied by a strong turnaround in growth.

On this account, we see range-bound inflation whilst growth returns gradually, providing the central bank with the comfort to remain on-hold during this phase, not rushing to tighten policy. A modest fiscal slippage is expected but not a deviation from the consolidation path. Oil prices remain the most uncertain part of the price outlook

4:18 PM

Nomura on RBI policy

The policy outcome was largely in line with expectations. Although there could be some downside risk to the RBI’s FY18 GVA growth projection, we believe that growth is headed higher, supported by ongoing remonetisation, resolution of GST-related issues and large bank recapitalisation. Meanwhile, risks to near-term inflation have risen on higher oil prices and rising vegetable prices, while the cobweb cycle (adverse supply response to low food prices in H1 2017) and higher growth are medium-term risks. Overall, we believe that both growth and inflation are headed higher, but we expect rates to be on hold through 2018 as the RBI has a sufficient real rate cushion to absorb higher inflation

The policy outcome was largely in line with expectations. Although there could be some downside risk to the RBI’s FY18 GVA growth projection, we believe that growth is headed higher, supported by ongoing remonetisation, resolution of GST-related issues and large bank recapitalisation. Meanwhile, risks to near-term inflation have risen on higher oil prices and rising vegetable prices, while the cobweb cycle (adverse supply response to low food prices in H1 2017) and higher growth are medium-term risks. Overall, we believe that both growth and inflation are headed higher, but we expect rates to be on hold through 2018 as the RBI has a sufficient real rate cushion to absorb higher inflation

4:05 PM

Market rundown by Anand James, Chief Market Strategist, Geojit Financial Services

"RBI's decision to maintain status quo was widely expected in the market but weakness in global indices meant that there was little impetus to push ahead. With MPC raising inflation expectations while retaining growth estimates for FY 17-18, markets would now keep an eye on budget cues for further direction."

3:46 PM

Nifty Fin services index also slipped over 1%

Source: NSE

3:44 PM

Nifty Bank index down pver 1% post RBI policy outcome

Source: NSE

3:42 PM

Sectoral trend

Source: NSE

3:40 PM

Top Sensex gainers and losers

Source: BSE

3:38 PM

Broader Markets

The BSE Midcap index underperformed the benchmark indices down 0.9% for the day while the BSE smallcap index ended 0.7% lower.

The BSE Midcap index underperformed the benchmark indices down 0.9% for the day while the BSE smallcap index ended 0.7% lower.

3:37 PM

Markets at Close

The S&P BSE Sensex ended the day at 32,597, down 205 points while the broader Nifty50 index settled at 10,044, down 74 points

The S&P BSE Sensex ended the day at 32,597, down 205 points while the broader Nifty50 index settled at 10,044, down 74 points

3:16 PM

Upasna Bhardwaj, senior economist, Kotak Mahindra Bank on RBI policy

RBI’s policy was in line with expectations, maintaining a word of caution on the upside risks emanating from high commodity prices, global financial instability, HRA related increases, rising input costs and fiscal slippages.

RBI’s 2H inflation has been revised marginally higher by 10bps to 4.3-4.7% even as they retained the GVA forecast of 6.7% as against our expectation of 6.5%. Given that MPC members are fixated with anchoring 4% inflation target and the upside risks emanating from higher oil prices, higher rural real wages, sticky core inflation and mean reversion of food prices, we find limited room for any further monetary accommodation this year

Topics :

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Dec 06 2017 | 3:30 PM IST