RIL's past bonus issues fail to lift sentiment

After the latest bonus issue, the paid-up equity share of RIL will double from 3,251 mn to 6,503 mn

)

premium

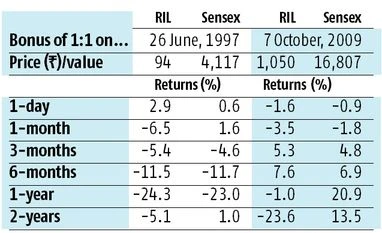

Shareholders might have cheered the bonus issue announcement by Reliance Industries (RIL) at its annual general meeting (AGM), however, it may not alter the oil-to-telecom conglomerate’s fortunes by much looking at the past. Previous two bonuses— in 1997 and 2009 — by the country’s most valuable company, have failed to fuel any rally in its stock price. In fact, the RIL scrip had mostly underperformed the benchmark S&P BSE Sensex over a short-to-medium term period after 1997 and 2009 bonus issues (see table).