Sebi plans to overhaul stock exchange norms

In line with Bimal Jalan panel proposals, new rules may allow exchanges to revise directors' pay

)

premium

Graph

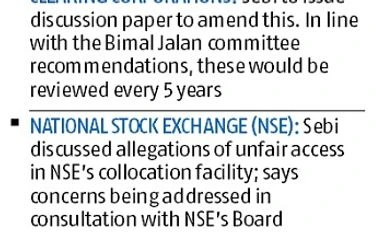

The Securities and Exchange Board of India (Sebi), at its board meeting in New Delhi on Saturday, proposed to review regulations for stock exchanges and clearing corporations.

The market regulator said it would float a discussion paper. The proposal is in line with recommendations of a committee headed by Bimal Jalan, former Reserve Bank of India governor.

Sources said the new regulations might allow stock exchanges and clearing corporations to align salaries of their directors with the Companies Act. At present, directors of stock exchanges are paid only sitting fees.

The customary post-Budget board meeting was attended by Finance Minister Arun Jaitley and newly appointed Sebi Chairman Ajay Tyagi. This was outgoing chairman U K Sinha’s last board meeting.

Sebi also discussed allegations of unfair access at the National Stock Exchange’s (NSE’s) co-location facility and reviewed the participatory note (p-note) framework.

On the issue of unfair access at the NSE, Sebi said its technical advisory committee and the exchange’s board were addressing concerns related to systems and processes. “The board took note of steps taken by Sebi to strengthen data dissemination, monitor service quality of data feeds, manage system load, and direct connectivity between co-location facilities of exchanges,” Sebi said in a release.

The NSE faces allegations of allowing unfair access to trade data to some brokers at a co-location facility, which came to light in 2012 after a whistleblower wrote to Sebi.

The market regulator said it would float a discussion paper. The proposal is in line with recommendations of a committee headed by Bimal Jalan, former Reserve Bank of India governor.

Sources said the new regulations might allow stock exchanges and clearing corporations to align salaries of their directors with the Companies Act. At present, directors of stock exchanges are paid only sitting fees.

The customary post-Budget board meeting was attended by Finance Minister Arun Jaitley and newly appointed Sebi Chairman Ajay Tyagi. This was outgoing chairman U K Sinha’s last board meeting.

Sebi also discussed allegations of unfair access at the National Stock Exchange’s (NSE’s) co-location facility and reviewed the participatory note (p-note) framework.

On the issue of unfair access at the NSE, Sebi said its technical advisory committee and the exchange’s board were addressing concerns related to systems and processes. “The board took note of steps taken by Sebi to strengthen data dissemination, monitor service quality of data feeds, manage system load, and direct connectivity between co-location facilities of exchanges,” Sebi said in a release.

The NSE faces allegations of allowing unfair access to trade data to some brokers at a co-location facility, which came to light in 2012 after a whistleblower wrote to Sebi.