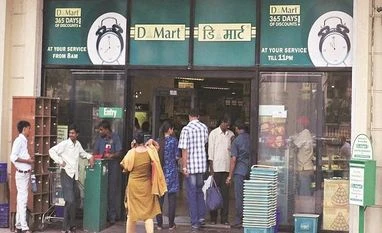

Sharp profit revision, fewer store openings may dent prospects of DMart

Given the near-term sales headwinds, the stock could be under pressure; investors can consider the stock on dips

)

premium

Due to the higher purchase of essentials — especially in the first half of FY21 — the share of food rose 500 basis points YoY to 57.4 in FY21

Muted sales expectations for FY22, fewer store openings, and a higher proportion of low-margin grocery (food) sales have led to sharp earnings downgrades for Avenue Supermarts or DMart for the current financial year.

While the margin profile was improving as reflected in the March quarter performance and management commentary, given the lockdown in multiple states, the trend is expected to reverse. The operating profit margin for the quarter was higher by 157 basis points, to 8.3 per cent. The company indicated there had been a revival in discretionary spends not seen in the previous three quarters.

Due to the higher purchase of essentials — especially in the first half of FY21 — the share of food rose 500 basis points YoY to 57.4 in FY21. The share of general merchandise and apparel fell by a similar proportion last year and was a key reason for the muted margin (2.9-6.2 per cent) performance in the first two quarters.

While the March quarter performance was better than expected, especially on the profitability front, it did not have many surprises as the company had already reported the revenue growth performance in its Q4 update in April. The Street will look beyond this and on to the sales impact of the lockdown.

While the margin profile was improving as reflected in the March quarter performance and management commentary, given the lockdown in multiple states, the trend is expected to reverse. The operating profit margin for the quarter was higher by 157 basis points, to 8.3 per cent. The company indicated there had been a revival in discretionary spends not seen in the previous three quarters.

Due to the higher purchase of essentials — especially in the first half of FY21 — the share of food rose 500 basis points YoY to 57.4 in FY21. The share of general merchandise and apparel fell by a similar proportion last year and was a key reason for the muted margin (2.9-6.2 per cent) performance in the first two quarters.

While the March quarter performance was better than expected, especially on the profitability front, it did not have many surprises as the company had already reported the revenue growth performance in its Q4 update in April. The Street will look beyond this and on to the sales impact of the lockdown.

Topics : DMart Avenue Supermarts Indian stock market