UTI MF beats peers in terms of assets from small towns

Smaller cities contribute 33% of its assets

)

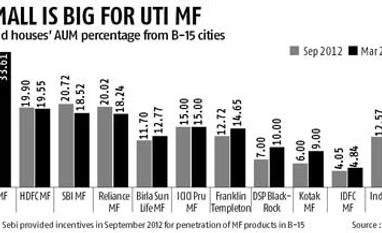

UTI Mutual Fund, India’s oldest and fifth-largest fund house has, overtaken the big boys in the sector when it comes to assets under management (AUM) from the country’s hinterland. Against the average of 13.65 per cent of the sector’s assets being accounted for by beyond-the-top-15 cities, or B-15, 33.6 per cent of UTI’s assets are from these regions.

HDFC Mutual Fund, India’s largest fund house, had less than 20 per cent of its assets from B-15 towns, while for Reliance MF and ICICI Prudential, this stood at 18.2 per cent and 15 per cent, respectively.

In September 2012, when the Securities and Exchange Board of India (Sebi) had offered incentives to monetise funds from smaller cities, 26 per cent of UTI’s assets were from B-15 towns.

Penetration of mutual fund products in India’s rural regions has been much talked about, especially since Sebi, in September 2012, allowed fund houses to charge extra to bring more assets from smaller cities. However, despite Sebi's initiatives, nothing much has changed in terms of large fund houses’ AUM from B-15 towns. In a few cases, AUM from B-15 towns has shrunk. Fund houses such as HDFC MF, Reliance MF and SBI MF have witnessed declines in AUM from B-15.

What helped UTI?

“During the last few years, we have been aggressively pursuing retailisation of debt products. We undertook investor education campaigns to simplify debt funds and show how these were better than bank deposits. The strategy worked and we could gain in B-15 towns,” said Debashish Mohanty, country head (retail business), UTI Mutual Fund.

UTI’s efforts came at a time when debt schemes have been seeing substantial traction in the last few years. Statistics suggest since the global economic slowdown of 2008, retail folios in debt schemes have risen from 2.5 million to 5.6 million. During this period, debt retail AUM jumped from Rs 8,000 crore to about Rs 30,000 crore. UTI reaped the benefits.

Mohanty said redemptions in equity schemes from B-15 towns weren’t as much as from T-15 (top 15 cities). “This was another factor that helped our AUM from B-15 rise.”

As of March this year, UTI's average AUM stood at Rs 74,233 crore. Of this, 39 per cent was accounted for by retail, significant compared to the sector average of about 20 per cent. UTI has 150 branches and 430 franchisee-owned ones. This financial year, it plans to add 101 branches on its own, most in B-15 towns.

Assets from cities such as Mumbai, Delhi, Bangalore, Chennai and Kolkata account for merely 51.76 per cent of its AUM, against 58-82 per cent for its peers. “There is lot of potential in T-15 cities, too. I do not think retail penetration in top cities has reached saturation point; that's not a true assessment,” Mohanty said.

The chief executive of a large fund house said, “It (UTI) is a strong brand and investors connect with it quickly. However, one should not always go with AUM percentage. One needs to see the number of fresh sales coming from B-15 cities.”

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: May 08 2014 | 12:38 AM IST