Driving digitisation

Dividing people on their propensity to embrace technologies can help attain goal of cashless economy

)

premium

Graphic

The pronouncements and predicaments of the demonetisation tsunami have still not ebbed. The new wave of digitisation and the cashless economy is consuming more ink in print and burning more bytes in social media than any other topic. The debate is on whether or not we have enough penetration of technology, power, internet and point of sales (PoS) terminals, willing retailers and consumers, and so on. And, given that the annual cost of cash operations for banks is Rs 21,000 crore, going cashless certainly makes great sense. But the manner in which we are going about it is debatable.

While we can thump our chests for having the highest growth in Internet usage and one of the highest mobile phone penetration rates globally, we had better hang our heads in shame for the slowest Internet speeds in the world and low PoS penetration. As always, India is full of paradoxes: The mobile proximity payment penetration is a disastrous two per cent, even though we have more mobile phones in use than toothbrushes; penetration of FMCG products is decent, yet that of PoS terminals is a low five per cent, at 700,000 retail outlets; high telecom penetration provides last mile connectivity, but the RBI will not allow telecom operators to provide essential banking services. The list goes on.

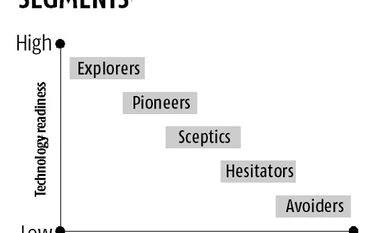

There are challenges aplenty for a sudden shift from a 95 per cent cash economy to a “cash-less” economy. Non-tech and behavioural challenges will delay adoption as much as, if not more than, infrastructural and technical challenges. Tomes have been written about this, but policymakers and service providers need to think about efficient ways of driving tech adoption. My intent here is to spotlight how various service providers should strive to deliver the government’s vision using the “technology readiness” of people — their propensity to embrace and use new technologies for accomplishing work/life goals — as a way to segment and facilitate efficient penetration and adoption.

If, as a service provider, you do not know your prospects’ readiness to embrace tech-based offerings, you will be wasting a lot of resources barking up the wrong tree. Lack of such knowledge is the cause of anguish and scepticism today. None of the banks, or even non-banks such as Paytm, bothered to investigate and drive the penetration issue but continued to focus on the five per cent until DeMo happened. Not all of us are wired the same way and not equally enthusiastic about technology, just as we are not for, say, Colgate, Head & Shoulders or Dove. Technology adoption is not necessarily dependent on where you live (rural vs urban), how educated you are, what income you earn or even tech penetration to some extent. It is inherent to individuals in various ways.

Highly educated and middle-class urban adults have been found to keep more than Rs 2 lakh in cash at home for “unanticipated needs”. Despite their knowledge and access, they exhibit discomfort or insecurity. On the other hand, lots of uneducated and poor farmers in remote Haryana villages use mobile phones to sell their produce, doing so with optimism and innovativeness. Indeed, this paradoxical phenomenon highlights the need for measuring people’s propensity to embrace cashless.

While we can thump our chests for having the highest growth in Internet usage and one of the highest mobile phone penetration rates globally, we had better hang our heads in shame for the slowest Internet speeds in the world and low PoS penetration. As always, India is full of paradoxes: The mobile proximity payment penetration is a disastrous two per cent, even though we have more mobile phones in use than toothbrushes; penetration of FMCG products is decent, yet that of PoS terminals is a low five per cent, at 700,000 retail outlets; high telecom penetration provides last mile connectivity, but the RBI will not allow telecom operators to provide essential banking services. The list goes on.

There are challenges aplenty for a sudden shift from a 95 per cent cash economy to a “cash-less” economy. Non-tech and behavioural challenges will delay adoption as much as, if not more than, infrastructural and technical challenges. Tomes have been written about this, but policymakers and service providers need to think about efficient ways of driving tech adoption. My intent here is to spotlight how various service providers should strive to deliver the government’s vision using the “technology readiness” of people — their propensity to embrace and use new technologies for accomplishing work/life goals — as a way to segment and facilitate efficient penetration and adoption.

If, as a service provider, you do not know your prospects’ readiness to embrace tech-based offerings, you will be wasting a lot of resources barking up the wrong tree. Lack of such knowledge is the cause of anguish and scepticism today. None of the banks, or even non-banks such as Paytm, bothered to investigate and drive the penetration issue but continued to focus on the five per cent until DeMo happened. Not all of us are wired the same way and not equally enthusiastic about technology, just as we are not for, say, Colgate, Head & Shoulders or Dove. Technology adoption is not necessarily dependent on where you live (rural vs urban), how educated you are, what income you earn or even tech penetration to some extent. It is inherent to individuals in various ways.

Highly educated and middle-class urban adults have been found to keep more than Rs 2 lakh in cash at home for “unanticipated needs”. Despite their knowledge and access, they exhibit discomfort or insecurity. On the other hand, lots of uneducated and poor farmers in remote Haryana villages use mobile phones to sell their produce, doing so with optimism and innovativeness. Indeed, this paradoxical phenomenon highlights the need for measuring people’s propensity to embrace cashless.

Disclaimer: These are personal views of the writer. They do not necessarily reflect the opinion of www.business-standard.com or the Business Standard newspaper