Hotel Leela Venture reducing the debt

Sale of hotels and non-core assets should bring down loans to manageable levels

)

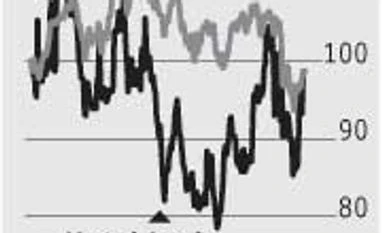

After Hotel Leela announced the sale of its Goa property to MetTube Malaysia, the company stock was up as much as 7.5 per cent intra-day trade on Monday. It, however, gave up a large part of the gains, closing at 0.5 per cent higher at Rs 21.5.

Given the 50-acre, 206-room premium property was sold at Rs 725 crore, the per-room valuation comes to about Rs 3.5 crore, at the lower end of the valuation band of Rs 3.5-4 crore. The sale means about 15 per cent (Rs 119 crore) of the company’s FY15 revenue of Rs 762 crore will no longer flow into its consolidated revenues.

More, the gross profit margin of the Goa property, at 44 per cent, was the highest across its domestic hotel portfolio, which means a major impact on profits. Some of this, however, will return as fee-income, as Hotel Leela will continue to manage the property.

The sale of the property, coupled with the fact that a Chennai hotel property also up for sale, is part of the company’s strategy to restructure debt, follow an asset-light strategy and manage more hotels. The Chennai property is expected to fetch about Rs 1,800 crore, or Rs 5.5 crore a room, and is expected to be sold at a premium. Together, the two properties should help halve the company’s debt to Rs 2,500 crore.

The company is also looking to sell other non-core assets such as an office space next to the Chennai Palace property, a high-end commercial property in Pune, and prime property in Hyderabad. While these might take a while, analysts say non-core or land sales are vital if the company is to manage its debt.

The company’s revenue from operations has not been enough to service its interest payment on consolidated debt of about Rs 5,000 crore. While its operating profit for FY15 was about Rs 151 crore, interest costs were Rs 197.5 crore. Interest costs would have been higher had the company included the interest and penalties for debt assigned to an asset reconstruction company (Rs 4,000 crore). Including the same, it would have coughed up Rs 782 crore in interest costs for FY15.

Further, with total revenue flattish and expenditure rising, the operating profit fell about 25 per cent year-on-year in FY15. The debt rose 74 per cent to about Rs 5,000 crore due to the high capital expenditure on the Delhi hotel project. Growth moderation, especially for business hotels, has hit occupancies and average room rates.

There are talks of a small equity offering, too.

Given the 50-acre, 206-room premium property was sold at Rs 725 crore, the per-room valuation comes to about Rs 3.5 crore, at the lower end of the valuation band of Rs 3.5-4 crore. The sale means about 15 per cent (Rs 119 crore) of the company’s FY15 revenue of Rs 762 crore will no longer flow into its consolidated revenues.

More, the gross profit margin of the Goa property, at 44 per cent, was the highest across its domestic hotel portfolio, which means a major impact on profits. Some of this, however, will return as fee-income, as Hotel Leela will continue to manage the property.

The company is also looking to sell other non-core assets such as an office space next to the Chennai Palace property, a high-end commercial property in Pune, and prime property in Hyderabad. While these might take a while, analysts say non-core or land sales are vital if the company is to manage its debt.

The company’s revenue from operations has not been enough to service its interest payment on consolidated debt of about Rs 5,000 crore. While its operating profit for FY15 was about Rs 151 crore, interest costs were Rs 197.5 crore. Interest costs would have been higher had the company included the interest and penalties for debt assigned to an asset reconstruction company (Rs 4,000 crore). Including the same, it would have coughed up Rs 782 crore in interest costs for FY15.

Further, with total revenue flattish and expenditure rising, the operating profit fell about 25 per cent year-on-year in FY15. The debt rose 74 per cent to about Rs 5,000 crore due to the high capital expenditure on the Delhi hotel project. Growth moderation, especially for business hotels, has hit occupancies and average room rates.

There are talks of a small equity offering, too.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Sep 21 2015 | 9:35 PM IST