<b>Ramakrishnan T S</b>: A conservative estimation of tax revenue

That has been the signature item of Finance Minister Arun Jaitley's Budgets

)

premium

Data

When the finance minister (FM) revealed the tax collections data of the first three quarters of FY 2016-17 in the second week of January 2017, questions were raised about the authenticity of the data by some quarters, including Mohan Guruswamy, chairman, Centre for Policy Alternatives, stating that all these figures were guesstimates. It is easy to check whether the claims made by the FM are real or guesstimates, with the revised tax collections available for FY 2016-17 in the Budget presented on February 1.

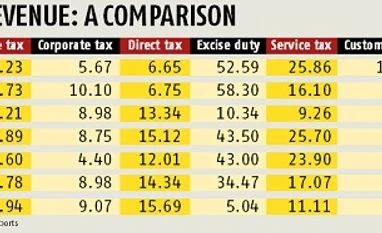

Table 1 compares the growth in tax revenues at different time periods to measure the growth in tax revenues collated and calculated from various sources. To assess the veracity of data on tax collections, at least three methods may be adopted. In the first method, the tax revenue growth of the first eight months and nine months of FY 2016-17 with the first nine months of FY 2015-16 was compared. This would give an indication whether the growth in tax revenues in the first three quarters of FY 2016-17 has been consistent with that in the first three quarters of FY 2015-16. This would also indicate how the growth pattern of various tax revenues accrue over the first three quarters.

Table 1 compares the growth in tax revenues at different time periods to measure the growth in tax revenues collated and calculated from various sources. To assess the veracity of data on tax collections, at least three methods may be adopted. In the first method, the tax revenue growth of the first eight months and nine months of FY 2016-17 with the first nine months of FY 2015-16 was compared. This would give an indication whether the growth in tax revenues in the first three quarters of FY 2016-17 has been consistent with that in the first three quarters of FY 2015-16. This would also indicate how the growth pattern of various tax revenues accrue over the first three quarters.

Disclaimer: These are personal views of the writer. They do not necessarily reflect the opinion of www.business-standard.com or the Business Standard newspaper