NHAI bonds offer similar rates to NBFCs, but should you invest in them?

However, retail investors should analyse risk of NBFCs more diligently

)

premium

The National Highways Authority of India (NHAI) has filed draft papers with Securities and Exchange Board of India to raise Rs 100 billion for public issue of taxable, secured redeemable non-convertible bonds for retail investors. These bonds may offer 8.50-9 per cent interest across tenors, including three-, five-, and 10-year maturities.

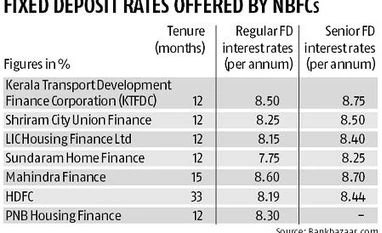

The interest rates are similar to those being offered by many non-banking financial companies (NBFCs). For instance, Bajaj Finance is currently offering 8.75 per cent on their one- to five-year fixed deposits (FDs) for its new customers.

In comparison, State Bank of India, the largest bank in the country, is offering an interest rate of 6.85 per cent for a 5-10-year FD – these are comparable rates, as FDs of over five years get tax benefits under Section 80C, if the limit of Rs 150,000 hasn’t been exhausted.

The interest rates are similar to those being offered by many non-banking financial companies (NBFCs). For instance, Bajaj Finance is currently offering 8.75 per cent on their one- to five-year fixed deposits (FDs) for its new customers.

In comparison, State Bank of India, the largest bank in the country, is offering an interest rate of 6.85 per cent for a 5-10-year FD – these are comparable rates, as FDs of over five years get tax benefits under Section 80C, if the limit of Rs 150,000 hasn’t been exhausted.