Are Long-Term Car Insurance Policies Worth It?

.

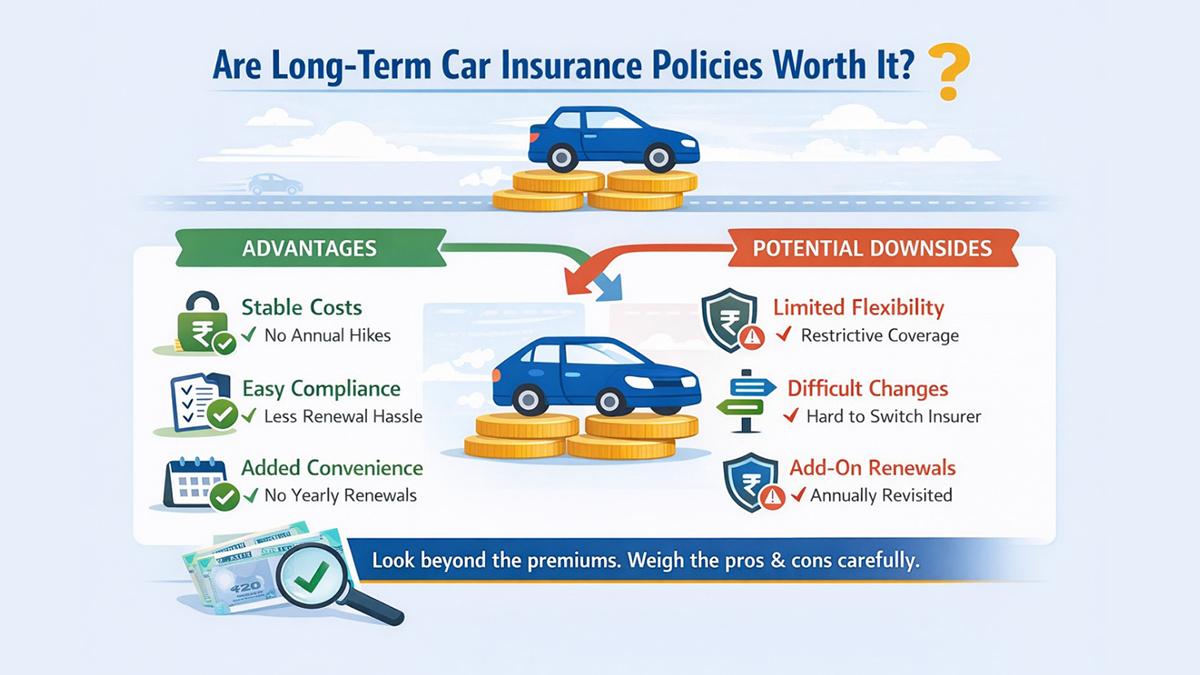

When people buy or renew car insurance, most choose one-year policies without much thought. However, long-term car insurance plans have started to become more common. These policies offer coverage for three years on new cars and up to five years for third-party liability. While they claim to bring ease and keep costs more predictable, many drivers still ask themselves: is a long-term car insurance plan worth it?

To figure this out, you need to look deeper than the obvious perks. It’s essential to see how these plans affect costs, flexibility, coverage, and overall peace of mind.

What Does Long-Term Car Insurance Mean?

A long-term car insurance policy provides coverage for your vehicle for several years all in one contract. You do not have to renew it every year. Instead, a single payment keeps you insured for the whole duration. These policies are often available for third-party insurance, which is required by Indian law as well as for comprehensive plans for brand-new cars.

New buyers might find these long-term plans a bit intimidating because of the higher upfront payment. But the benefit comes from having consistent costs and less hassle over the years.

Stable Costs: Avoiding Yearly Premium Hikes

One big perk of getting long term car insurance is avoiding yearly premium increases. Premium rates often change because of new rules, inflation, or market shifts. By choosing a multi-year plan, you secure a fixed rate for the whole policy period.

To buy car insurance this way could save you a lot in the long run if rates keep climbing every year. Even though the upfront cost is more, it ends up being cheaper than paying for yearly renewals.

Advantages in Ease and Following Rules

Renewing policies every year can lead to risks like missing deadlines, letting the policy lapse, or making hasty decisions at the last moment. Opting for a long-term policy takes away these worries. Once you buy it, your insurance stays active for years so you do not have to think about renewals or losing coverage.

This is helpful in India because driving without valid car insurance can lead to fines and legal issues. Long-term insurance helps you stay on the right side of motor insurance rules without gaps.

The Other Side: Limited Freedom

While long-term car insurance offers benefits, it limits flexibility. Changing insurers, modifying coverage, or adding features can be restricted. If you sell your car before the policy ends, cancellations or refunds may involve conditions and deductions.

Extra Features and Choice in Coverage

Add-ons like zero depreciation, engine protection, and roadside help are often available for one year at a time even if you opt for a multi-year plan. This means you might have to check and renew these extras every year, which takes away from the convenience of a long-term policy.

That said, many insurers let you choose and adjust add-ons right when you buy the policy. This flexibility helps you match your coverage to your specific driving habits from the beginning.

Who Should Think About Choosing Long-Term Car Insurance?

Long-term insurance is a good fit if you:

- Just bought a new car and plan to keep it for a few years

- Like having fixed and predictable costs

- Want to skip the hassle of frequent policy renewals

- Don’t often feel the need to switch insurers

However, drivers who often compare and switch policies to find better deals or those who change vehicles might find annual plans more efficient and manageable.

Choosing What's Best for You

Long-term car insurance gives you steady costs, legal compliance, and added convenience. But it might not work well in every situation. It’s important to think about how you drive, how long you plan to keep your car, and whether you’re okay with a long-term deal before making a choice.

To seek reliable coverage with a focus on customer care, Chola MS Car Insurance offers adaptable car insurance plans. These plans combine consistent protection and reliable service keeping you covered every mile you travel.

FAQs

1. Is it possible to cancel a long-term car insurance plan?

You can cancel the policy, but whether you get a refund or not depends on the terms set by the insurance company. Some deductions might apply.

2. Can you get a No Claim Bonus with long-term insurance?

Yes, insurers apply NCB even if you have a long-term comprehensive policy.

3. Do add-ons last for the full term?

In most cases, add-ons are renewed every year regardless of how long the main policy lasts.

4. Should you buy long-term car insurance online?

Buying car insurance online for long-term plans is a good idea. It lets you compare easily, ensures transparent prices, and speeds up the process.

Disclaimer: No Business Standard Journalist was involved in creation of this content

Topics : long-term car insurance

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Dec 29 2025 | 4:49 PM IST