Share.Market's Second CRISP Mutual Fund Scorecard Emphasises on Investment Style Diversification & Risk Over Returns

.

- Funds with Value and Momentum tilt continue to dominate in performance consistency

- Funds with ‘High’ performance consistency can come with ‘High’ risk

Share.Market (PhonePe Wealth) released the second edition of its CRISP Mutual Funds Scorecard for the quarter ending June 2025. The scorecard covers analysis of funds in core equity and hybrid fund categories, based on the 5-year data ending June 2025. It leverages Share.Market’s in-house fund evaluation framework, CRISP, to provide a comprehensive, data-driven analysis of mutual funds, offering insights on their performance, risk, and investment style.

Sharing his views on the scorecard, Nilesh D Naik, Head of Investment Products, Share.Market (PhonePe Wealth) said, “With the growing adoption of mutual funds there is a clear need for simple yet relevant insights that go beyond past returns. At Share.Market, we developed the CRISP (Consistency, Risk and Investment Style of Portfolio) framework to offer investors a more holistic view that brings together performance, relative risk, and investment style. The CRISP Mutual Funds Scorecard is our way of empowering millions of investors with deeper, actionable insights on how their money is being managed. This second edition builds on that promise, and commitment guided by investor needs and driven by our belief in making data-backed investing more accessible for all.”

The second edition of the report highlighted that funds with Value and Momentum tilt continue to perform consistently. In categories such as Large Cap, Midcap, ELSS, Contra/Value, Large & Midcap, and Aggressive Hybrid, funds favouring value investment style have emerged as consistent performers while in Small Cap and Flexi Cap categories, funds high on Momentum style were among the top performers.

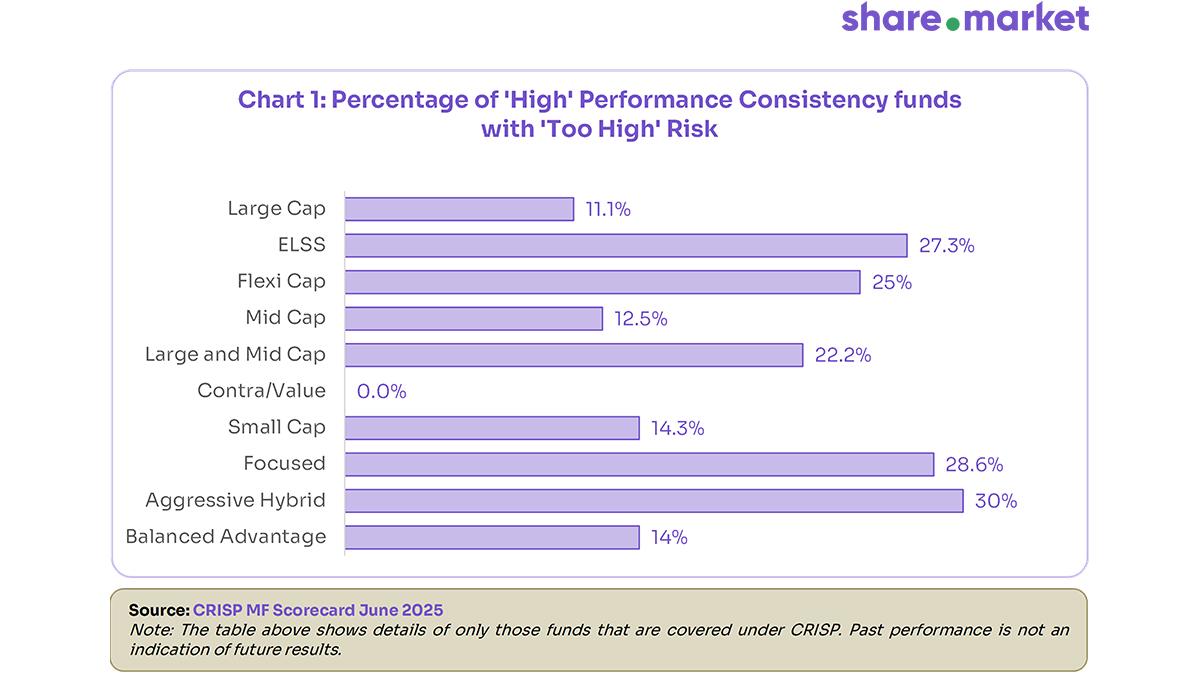

Additionally, the report highlights that a few funds with ‘High’ performance consistency have been outliers in terms of risk. Individual Investors tend to emphasize on performance or point-to-point returns of a fund, thereby creating a portfolio with high-risk concentration. The Scorecard revealed that among funds with ‘High’ performance consistency in categories such as Flexi Cap, ELSS, Focused and Aggressive Hybrid Funds, 25-30% of the funds were scored ‘Too High’ on Risk. Therefore, it becomes imperative for investors to consider risk as a factor along with performance consistency to build a resilient portfolio.

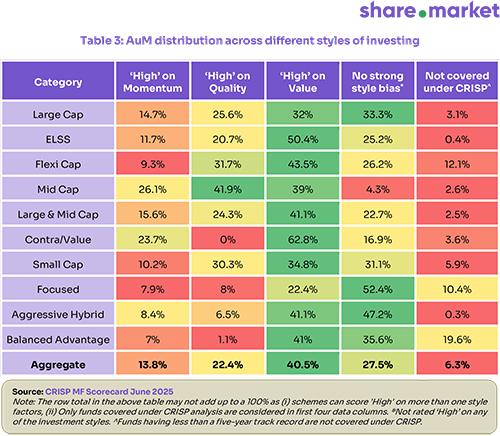

Another challenge spotlighted in the report is that many investors believe holding funds across multiple categories and AMCs provides diversification. However, a single style exposure could also lead to significant portfolio underperformance. The CRISP Scorecard revealed that:

- 40% of the total AuM of funds analysed are concentrated in funds that are ‘High’ on the Value investment style.

- Momentum, the second most dominant investment style among funds showing high performance consistency commands only ~14% of AuM.

- Approx 28% of the assets are in funds that do not follow any particular investment style, and ~22% is in funds that focus on buying high-quality companies.

A smart combination of styles can help reduce volatility and ensure relatively smoother returns over time. To avoid style concentrations, the CRISP framework plays a crucial role in helping investors recognize and assess the underlying style exposures in their portfolios.

The CRISP Scorecard identified the top AMCs by performance consistency as:

- Nippon India, HDFC, and ICICI Prudential were among the most consistent performers across multiple fund categories.

- quant AMC showcased high performance consistency across seven categories, though its funds showed significantly higher volatility.

- HDFC AMC funds largely followed Value style while Nippon and ICICI Prudential had a mix of Value tilt and style-neutral funds.

- Edelweiss with strong Momentum tilt, and Franklin Templeton with a preference for Value style, delivered high performance consistency across five categories each.

The second edition of the CRISP Mutual Fund Scorecard underscores the importance of analysing both a fund's underlying risk, not just its performance, and its investment style for true portfolio diversification. For investors, these insights provide a significant opportunity to rethink portfolio diversification across various parameters.

For more information download the report from here.

Disclaimer: No Business Standard Journalist was involved in creation of this content

Topics : share market

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Aug 26 2025 | 12:05 PM IST