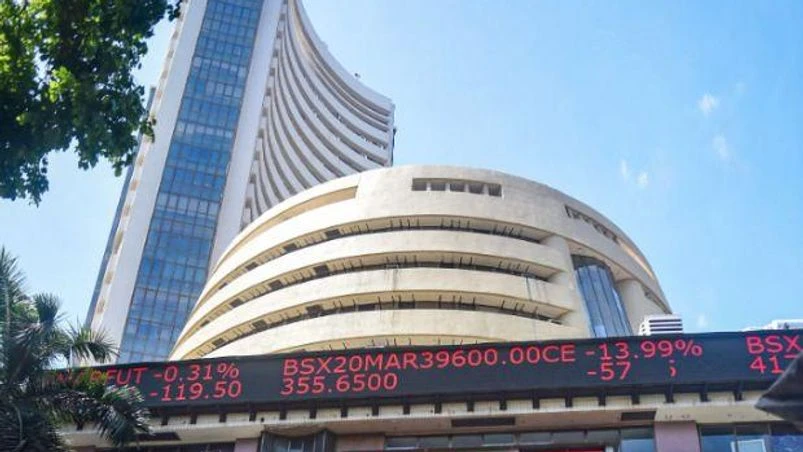

Market Ahead, July 21: Top factors that could guide markets today

Market Ahead, July 21: Top factors that could guide markets today

The Indian markets may open on a positive note today as indicated by the SGX Nifty which was trading around 11,118.50 levels, up 108 points at 7:45 AM

BS Web Team New Delhi

)

The Indian markets may open on a positive note today as indicated by the SGX Nifty which was trading around 11,118.50 levels, up 108 points at 7:45 AM.

In the overnight trade, US stocks gained ground and surging technology shares pushed the Nasdaq to a record closing high, as promising trial results from potential Covid-19 vaccines boosted investor sentiment.

Asian shares, too, were expected to open higher on encouraging data from trials of three potential Covid-19 vaccines and hopes that the European Union would finalise a recovery fund.

Besides global cues, investors will today focus on corporate results, other stock-specific developments, and trend in Covid-19 cases.

Over 60 companies, including Hindustan Unilever (HUL), Axis Bank, Bajaj Finance, Crisil, IndiaMART InterMESH, Polycab, and SBI Life, among others are slated to release their June quarter results later in the day.

On Tuesday, SBI Cards and Payment Services Ltd posted a 1 per cent drop in its profit before tax (PBT) at Rs 528 crore in the quarter ended June 2020 (Q1FY21). The PBT was Rs 533 crore in the quarter ended June 2019 (Q1FY20).

Shares of InterGlobe Aviation may trade actively today after IndiGo said it will shed 10 per cent of its workforce as the airline scrambles to control the impact of the Covid-19 pandemic.

Also Read

Meanwhile, striking down the telecom companies' demand for re-assessment of dues linked to adjusted gross revenue (AGR), the Supreme Court on Monday reserved its order with respect to the Department of Telecommunications (DoT) plea for a 20-year staggered payment timeline for the service providers.

On the Covid-19 front, the total number of confirmed coronavirus cases globally reached 14,645,947 on Monday, according to Worldometer.

And now, a quick look at other top headlines:

Larsen & Toubro Chairman A M Naik has struck a positive note in his letter to shareholders, saying H2 of FY21 could see better economic activity. Further, the company's board members may take a pay cut of up to 53%.

The government is looking to privatise more than half of its state-owned banks to reduce the number of PSU lenders to just five as part of an overhaul of the banking industry, according to reports.

More From This Section

Topics :Market AheadAsian markets

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Jul 21 2020 | 7:26 AM IST