As copra prices stablise, cost pressures likely to ease for Marico

The cost pressure marred the December 2017 quarter (Q3) performance of the country's largest hair oil company.

)

premium

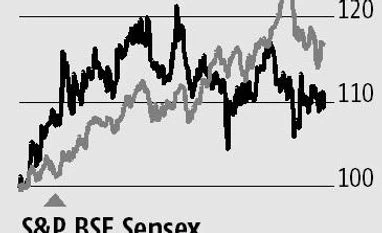

Shares of Marico underperformed the S&P BSE FMCG index and the S&P BSE Sensex in the last six months as sentiment turned sour due to input cost pressure.

The cost pressure marred the December 2017 quarter (Q3) performance of the country’s largest hair oil company.

The price of copra, a key raw material accounting for 45-50 per cent of its total raw material costs, has increased sharply in the previous quarters. Due to deficient north-east monsoon rainfall, copra prices were up 91 per cent year on year (y-o-y), in Q3.

Marico’s consolidated gross profit margin (gross profit, or the cost of goods sold, as percentage of net sales) contracted by 520 basis points (bps) y-o-y, and 50 bps sequentially. Gross margins moved south even for the company’s standalone business, which incorporates its India operations, including the Parachute and Saffola brands.

Though Marico has hiked prices by 11 per cent effective January 2018 (cumulative price hike of 20 per cent in FY18 to date), its gross profit margin is expected to remain under pressure in the next couple of quarters as copra prices are still higher than the year-ago level. “Copra prices are still on the higher side, therefore the price hikes will not be sufficient for an expansion in margin in Q4,” said Sachin Bobade, analyst at Dolat Capital.

The firm’s management has indicated that margin recovery is unlikely in the near term as copra prices are expected to soften after the next crop.

The cost pressure marred the December 2017 quarter (Q3) performance of the country’s largest hair oil company.

The price of copra, a key raw material accounting for 45-50 per cent of its total raw material costs, has increased sharply in the previous quarters. Due to deficient north-east monsoon rainfall, copra prices were up 91 per cent year on year (y-o-y), in Q3.

Marico’s consolidated gross profit margin (gross profit, or the cost of goods sold, as percentage of net sales) contracted by 520 basis points (bps) y-o-y, and 50 bps sequentially. Gross margins moved south even for the company’s standalone business, which incorporates its India operations, including the Parachute and Saffola brands.

Though Marico has hiked prices by 11 per cent effective January 2018 (cumulative price hike of 20 per cent in FY18 to date), its gross profit margin is expected to remain under pressure in the next couple of quarters as copra prices are still higher than the year-ago level. “Copra prices are still on the higher side, therefore the price hikes will not be sufficient for an expansion in margin in Q4,” said Sachin Bobade, analyst at Dolat Capital.

The firm’s management has indicated that margin recovery is unlikely in the near term as copra prices are expected to soften after the next crop.