Auto component makers gearing up for likely disruption from EV mobility

Many are diversifying into non-engine parts, and are focused on BS-VI, as they feel internal combustion will be around for a while

)

premium

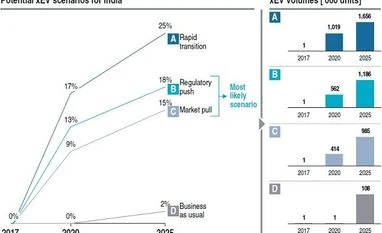

Over the past two years, the din around India’s ambitious plan to convert itself into an all-electric vehicle market by 2030 has been growing louder. Manufacturers of engine and transmission parts, who would be at the centre of the disruption, aren't worried, however. These companies account for more than half the $43.5 billion revenue of India’s auto component industry, according to Auto Component Manufacturers Association of India (Acma), the lobby for auto parts makers.

Even as these companies are looking to diversify into non-engine parts, scouting for acquisitions to stay relevant in the newly emerging eco-system, they are confident that internal combustion engine (ICE) is here to stay at least for a decade and half, if not more. To be sure, meeting the BS-VI emission norms, which kick off on April 1, 2020, is on top of their priority list.

Take the case of Shriram Pistons & Rings (SPR), one of the largest manufacturers of engine aggregates and parts, that counts almost every other automaker as its client. The company draws two-thirds of its revenue from engine related parts in the personal mobility space. As part of a risk mitigation strategy, SPR plans to strengthen presence in off-highway applications, tractors and such like, which are expected to be insulated from electric mobility. It is also stepping up presence in the aftermarket segments in India and abroad, says Ashok Taneja, managing director and chief executive at the firm. The company is also working towards diversifying into non-ICE parts and tapping into new areas, including braking and light-weighting by way of acquisition.

Others have a similar approach. “I think there will be lot of space for ICE for many years to come,” says Tarang Jain, managing director at Aurangabad-based Varroc Group, which makes lighting systems among other auto parts. Jain points out that transition has been slow even in most of the developed markets. However, he doesn’t want to be caught off-guard. His company, which draws a third of revenue from engine and emission parts, is working on the electronic motor side of the powertrain. Varroc is also looking for a collaboration with start-ups, and at acquisitions to tap into the EV space, but is not in a rush. “My immediate priority is BS-VI, he says.

The government's announcement on electric mobility has served as a huge distraction for an industry that has left no stone unturned to switch to world’s strictest emission norms, says Vinnie Mehta, director general at ACMA. Automobile and auto parts makers, and oil refiners are estimated to fork out anything between Rs 700 billion and Rs 900 billion as a run up to leapfrogging from BS-IV to BS-VI emission norms.

Even as these companies are looking to diversify into non-engine parts, scouting for acquisitions to stay relevant in the newly emerging eco-system, they are confident that internal combustion engine (ICE) is here to stay at least for a decade and half, if not more. To be sure, meeting the BS-VI emission norms, which kick off on April 1, 2020, is on top of their priority list.

Take the case of Shriram Pistons & Rings (SPR), one of the largest manufacturers of engine aggregates and parts, that counts almost every other automaker as its client. The company draws two-thirds of its revenue from engine related parts in the personal mobility space. As part of a risk mitigation strategy, SPR plans to strengthen presence in off-highway applications, tractors and such like, which are expected to be insulated from electric mobility. It is also stepping up presence in the aftermarket segments in India and abroad, says Ashok Taneja, managing director and chief executive at the firm. The company is also working towards diversifying into non-ICE parts and tapping into new areas, including braking and light-weighting by way of acquisition.

Others have a similar approach. “I think there will be lot of space for ICE for many years to come,” says Tarang Jain, managing director at Aurangabad-based Varroc Group, which makes lighting systems among other auto parts. Jain points out that transition has been slow even in most of the developed markets. However, he doesn’t want to be caught off-guard. His company, which draws a third of revenue from engine and emission parts, is working on the electronic motor side of the powertrain. Varroc is also looking for a collaboration with start-ups, and at acquisitions to tap into the EV space, but is not in a rush. “My immediate priority is BS-VI, he says.

The government's announcement on electric mobility has served as a huge distraction for an industry that has left no stone unturned to switch to world’s strictest emission norms, says Vinnie Mehta, director general at ACMA. Automobile and auto parts makers, and oil refiners are estimated to fork out anything between Rs 700 billion and Rs 900 billion as a run up to leapfrogging from BS-IV to BS-VI emission norms.