Online platforms make tax filing easy, help fill details automatically

If you have capital gains on a house or shares, they can automatically tell you the tax liability

)

premium

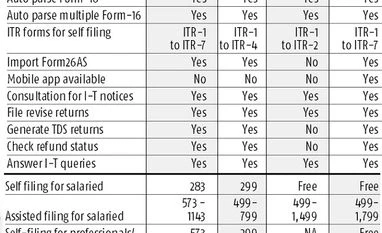

The Income Tax department on May 4 activated an e-filing facility in which you can start filing returns. The department has also simplified the ITR forms to make it easier for individuals to file returns. If you still find filing this a tedious, you can approach online tax filing websites. These platforms are using technology to shorten the process and avoid errors.

Shortening the process: If you are a salaried person, in most websites you can upload Form 16 on the website. Their software automatically picks the details and fills all the fields, avoid hassle of an individual typing each and every detail manually. These platforms can also parse multiple Form 16s, if the individual has changed jobs, and compute the tax liability. “If all the required details are handy, a salaried person can file tax returns within 10 minutes,” says Chetan Chandak, head of tax research, H&R Block India. If you have capital gains on a house or shares, these websites can automatically tell you the tax liability, once you enter the date of buying and selling and price at which you bought and sold the asset.

It’s not only for the salaried. These platforms have also simplified filing returns for business owners and professionals. Explains Archit Gupta, founder of Cleartax.com: “The ITR Form for business is a lengthy form with multiple pages. To simplify, we just ask around five questions to the taxpayer. Using the answers, we fill all the relevant details automatically.”

Shortening the process: If you are a salaried person, in most websites you can upload Form 16 on the website. Their software automatically picks the details and fills all the fields, avoid hassle of an individual typing each and every detail manually. These platforms can also parse multiple Form 16s, if the individual has changed jobs, and compute the tax liability. “If all the required details are handy, a salaried person can file tax returns within 10 minutes,” says Chetan Chandak, head of tax research, H&R Block India. If you have capital gains on a house or shares, these websites can automatically tell you the tax liability, once you enter the date of buying and selling and price at which you bought and sold the asset.

It’s not only for the salaried. These platforms have also simplified filing returns for business owners and professionals. Explains Archit Gupta, founder of Cleartax.com: “The ITR Form for business is a lengthy form with multiple pages. To simplify, we just ask around five questions to the taxpayer. Using the answers, we fill all the relevant details automatically.”