Telcos stare at Rs 6,000-cr hit on imports

10% Customs duty aimed at boosting domestic manufacturing will impact an industry that imports equipment worth $8-10 bn every year

)

For Indian telecom operators, "achhe din" (good days) are far behind. Their annual expenses will shoot up by at least Rs 3,000 crore ($500 million), and might go up to Rs 6,000 crore, starting this financial year, with Finance Minister Arun Jaitley proposing to impose a 10 per cent Customs duty on telecom products.

Operators - sitting on a cumulative debt of Rs 2.5 lakh crore - import telecom equipment worth $8-10 billion every year, and the imposition of 10 per cent duty comes as an additional burden.

To boost domestic manufacturing, Jaitley has proposed, in his Budget, that 10 per cent basic Customs duty would be imposed on specified telecom products that are outside the purview of the Information Technology Agreement (ITA).

"The 10 per cent Customs duty on specified telecom equipment imports can have an impact on the overall cost for the telecom industry at a time when India needs better capacity and coverage of mobile broadband networks to cater to the rapidly increasing mobile data traffic," said a spokesperson at Nokia Networks.

While the industry is yet to work out the final numbers, almost all telecom equipment required for 3G and long-term evolution (LTE) networks and related infrastructure are imported. "Companies import telecom equipment worth about $8-10 billion every year. The imposition of duty on telecom products would further increase infrastructure cost for telecom operators who are already burdened with huge debt," said Rajan Mathews, director-general, Cellular Operators Association of India (Coai).

Mathews said imposition of duty would increase expenses of the telecom companies and would not increase domestic sourcing. "More than 90 per cent of telecom equipment are imported, and advanced technology products are in no way available in the domestic market. The very little that are being assembled in India, or being manufactured, are actually imported and packaged here," said Mathews.

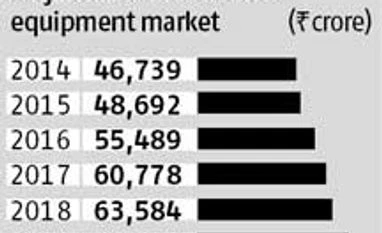

On the other hand, N K Goyal, chairman, Telecom Equipment Manufacturers Association of India (TEMA), said, "This will go a long way to promote indigenous manufacturing of telecom equipment and creation of jobs." Over the next three years, said Goyal, the size of the India-made telecom equipment would cross Rs 25,000 crore. According to TEMA estimates, the demand for telecom equipment in India was about Rs 76,940 crore in financial year 2013 and companies are expected to invest about Rs 5,21,940 crore by 2020.

Goyal said, in the financial year 2016, the requirement of 3G equipment is expected to be worth Rs 10,130 crore, while the demand for 4G equipment would be 12,660 crore.

According to the Telecom Systems Design and Manufacturing Association, Indian companies that design and manufacture and also have intellectual property rights, had just a about three per cent share of the estimated Rs 50,000-crore telecom equipment market in 2012-13.

Foreign companies, which have factories in India, would take this number to about 10 per cent. But, all the foreign companies with factories here just limit value addition in India to system integration and packaging, which would not be more than 10-11 per cent of the value of the product.

The telecom equipment business in India is mainly controlled by five companies - Huawei, ZTE, Ericsson, Nokia Networks, and Alcatel. Companies did not want to comment on the issue. As part of the government's initiatives to boost domestic manufacturing, in February 2012, it had announced a preference policy in which 30 per cent of the orders of government departments would be reserved for local telecom equipment makers, which would have to undertake a minimum value addition of 25 per cent.

The policy extended the quota to the private sector, too, asking it to source sensitive equipment from local manufacturers. Local equipment makers, however, blame cost disadvantage of about 20-25 per cent that they face as against the foreign companies. Finished telecom equipment so far imported at zero duty, but components bear a duty ranging from 10 per cent to 15 per cent. Indian telecom equipment makers also pay 16-18 per cent interest on loans, far above their Chinese rivals. According to industry estimates, import from China has a 30 per cent cost advantage.

- 90% of telecom equipment currently imported

- Rs 2.5 L cr Debt of the telecom companies in the country

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Jul 12 2014 | 12:47 AM IST