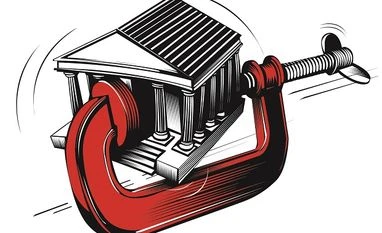

RBI's move to bar all debt-recast programmes will delay recovery: India Inc

RBI had said companies will get six months from March 1 to get their house in order or go for bankruptcy

)

Debt

Corporate leaders on Tuesday said the Reserve Bank of India’s (RBI’s) move to bar all corporate debt-recast programmes and send them to the National Company Law Tribunal (NCLT) after a six-month window is “disruptive” and will impede industrial revival.

“The RBI should first tell us how many of their previous plans, such as S4A, CDR, 5:25 schemes, etc, have worked? If these schemes were a failure, then the RBI should first acknowledge it. Now, what is the guarantee this scheme will help banks or corporate entities?” said a chief executive of a large infrastructure firm, asking not to be named.

“This move is disruptive and will certainly bring down credit growth of banks to the corporate sector, as no company will start a new project,” he added.

Late on Monday evening, the RBI scrapped all existing norms and said companies will get six months from March 1 to get their house in order or go for bankruptcy.

“If a scheme is not agreed upon and implemented already, then SDR (strategic debt restructuring) will no longer continue, as all schemes will be dismantled with immediate effect by the RBI,” said a corporate lawyer.

Also Read

This is likely to impact the debt-recast plans of infrastructure, power, telecom, and road companies, he added.

This comes at a time when industrial production moderated to 7.1 per cent on a year-on-year basis in December last year, despite a favourable base effect. The moderation was due to lower growth in manufacturing, infrastructure, and consumer goods.

The chairman of a large company said the RBI move would make sure that stalled projects in the power and infrastructure sectors would remain stalled. He added that the central bank should have taken into account external reasons that led to a company becoming a non-performing asset.

Many telecom companies turned defaulters after the Supreme Court cancelled licences granted by the government in 2012. Similarly, many power companies failed to take off as coal mine allotments were cancelled.

“The RBI is slowly shutting off the tap for corporate India. The government has to decide whether it wants investments or not,” he said.

Forty companies have already been sent to the NCLT.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Feb 14 2018 | 12:25 AM IST