Best unlisted companies

)

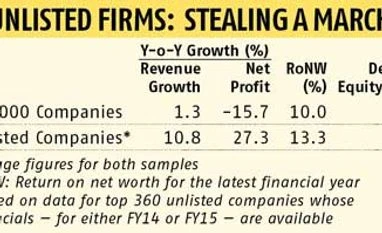

Do unlisted or closely held companies do a better job of managing an economic downturn than their listed counterparts? According to the data analysed by Business Standard, the top unlisted companies have reported faster revenue and profit growth last fiscal (either FY15 or FY14), compared to BS 1000 companies. Unlisted companies also reported superior return on net worth.

The combined revenues of 360 unlisted companies in the sample were up 10.8 per cent on a year-on-year basis, better than the 1.3 per cent growth reported by BS 1000 firms. Their combined net profit was up 27.3 per cent y-o-y, against a 15.7 per cent profit decline reported by the latter. (Unlisted companies)

Closely-held companies also score in terms of maximising shareholder returns, with average return on net worth (RoNW) of 13.3 per cent in FY15, against 10.5 per cent for listed companies. The level of indebtedness for both samples is similar, with a debt-equity ratio of 1.4.

The unlisted companies' sample is one-third the size of BS 1000 and a typical unlisted company is much smaller. The top unlisted company in our list, Bunge India, is one-seventh the size of the top BS 1000 company, Indian Oil, in terms of revenues.

Most unlisted companies are either Indian subsidiaries of global multinationals or government-owned enterprises. They include local subsidiaries of Bunge, Vodafone, Samsung, IBM, Hyundai, Honda, Cognizant, Mondelez and Hewlett Packard, among others. Government companies include state power utilities and defence firms. Most of them are largely focused on the domestic market, sheltering them from global macroeconomic headwinds unlike BS 1000 companies.

Given an opportunity, equity investors would love to see many of these companies getting listed on the bourses. Companies such as Frigorifco Allana, Samsung India, Coca-Cola India, International Tractors, Intex and Serum Institute deserve a place in most equity portfolios.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Feb 10 2016 | 12:10 AM IST