Funding in AirAsia takes a hit as promoters cut investment

Tata Sons along with Malaysia-based AirAsia Bhd are the promoters of the airline

)

Amidst allegations of misappropriation of funds in AirAsia India, the promoters significantly reduced their quantum of investment in the airline through the year, it is learnt. This is despite the airline needing funds to be able to expand its footprint after an initial slow start.

Tata Sons, along with Malaysia-based AirAsia Bhd are the promoters.

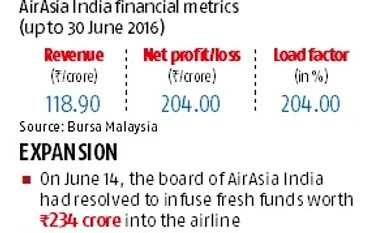

On June 14, the board of AirAsia India, had committed to infuse fresh funds worth Rs 234 crore into the airline. The two promoters — Tata Sons and Air Asia Malaysia — had agreed to approve a fresh issue of shares valuing the amount on a rights basis.

But, according to documents filed by the company and reviewed by Business Standard, the board, in a subsequent meeting on September 30, approved fresh shares worth Rs 51 crore, much lower than the original amount that was initially planned. Out of the

Rs 51 crore investments, around Rs 1 crore is through S Ramadorai and R Venkataramanan who are members of the Tata Trusts. Earlier in March, the two Tata Group executives, who are board members, had acquired two per cent stake in the airline.

Also Read

The cut in funding assumes significance with previous Tata Sons chief executive Cyrus Mistry, saying that Tata Sons was forced to enter the aviation sector through a joint venture with AirAsia as wished by Ratan Tata. ‘’Earlier in my tenure, our foray into aviation sector began when Mr Tata ushered me into his cabin and handed me a report on AirAsia. He had concluded negotiations with AirAsia and wanted the proposal to be tabled at the next board meeting. My push back was hard and futile,’’ Mistry wrote in the letter addressed to Tata Sons’ board of directors. Mistry also wrote that due to Ratan Tata’s personal passion for the airlines sector, Tata Sons board agreed to infuse the capital into the sector at multiple levels of the initial commitment.

An AirAsia spokesperson said the airline was in its growth phase and rapidly expanding its business but refrained from responding to a detailed query seeking comment over the reduction in funding. “Our business is growing and there is nothing stopping us from expanding our footprint in India. Our expansion, fleet induction and hiring strategy remain unchanged,” she said, adding there had been addition of new aircraft, new routes and roadshows and recruitment drives for bringing in pilots, cabin crew, ground staff and security personnel were in full swing. Another airline official said he expected the funds to come in tranches.

Experts feel the corporate battle at Tata Sons has impacted the decision but will be back on track. “See this as an interim funding till things are in order.

Rs 51 crore is extremely inadequate. AirAsia India is under capitalised at the moment,” said Kapil Kaul, CEO, South Asia at Sydney-based consultant CAPA-Centre for Aviation. Kaul added the slow growth had been a strategic compulsion, driven by continuing losses and inability to fund big scale operations. “AirAsia India has been an under-performer till date,” he said.

After an initial slow start, AirAsia India recently took steps to grow its operations, acquiring two aircraft in one month, announcing new locations and recruiting new faces at senior level. Chief executive Amar Abrol in recent media interactions said the promoters had agreed to infuse fresh funds which would drive its second phase of growth. The airline currently has eight aircraft and is flying to 11 destinations.

READ OUR FULL COVERAGE OF THE TATA-MISTRY BOARDROOM BATTLE

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Nov 16 2016 | 1:03 AM IST