Idea Cellular: Volume growth boosts show

However, voice realisations have fallen steeply due to competitive pressures leading to a fall in ARPM

)

It was volume growth that helped Idea Cellular report a better than expected March 2015 quarter performance. Helped by an increase in new subscribers and volume growth both on the data and voice segments, the company reported five per cent sequential growth in stand-alone revenues for the quarter at Rs 8,416 crore.

While subscribers increased five per cent, voice volumes were up by a sharp nine per cent, whereas data volumes continued to be strong, up 18 per cent over the December quarter. Revenue growth would have been higher but for the reduction in interconnect usage charge from 20 paise to 14 paise. The impact of the same on the revenues was pegged at Rs 105 crore by the company. Like-to-like revenue growth is stated at 6.3 per cent.

Ebitda margins for the quarter were up 200 basis points to 33.1 per cent on the back of higher scale and efficient operations as well as better profitability from its 15 established circles. While margins in the established circles stood at 37 per cent, it is yet to break even at the operating profit level in the seven newer circles. The company has a market share of 20 per cent in the 15 established areas, in eight of which it is either number one or two with average market share of 29 per cent.

Net profit for the quarter was up 59 per cent sequentially to Rs 1,077 crore while on a consolidated basis (including Indus Towers) it was up 23 per cent to Rs 941 crore, better than estimates that pegged it at Rs 831 crore. The stand-alone net profit includes dividend of Rs 160 crore.

While volume growth has been strong, pricing power is yet to show up though there has been talk of the same for some time now. For the third successive quarter, the company’s average revenue per minute (ARPM) for voice services remained muted. For the March quarter, voice ARPM was down five per cent on a sequential basis to 33.9 paise. Data realisations too were down 4.4 per cent to 25.7 paise, but that was largely expected. Overall ARPM thus was down by 3.2 per cent to 44.8 paise. Thus blended RPM has fallen for the first time in four quarters.

Given the spectrum payment and cost of expanding its network (capex for FY16 pegged at Rs 5,000-5,500 crore) cost pressures will increase. But, the company has indicated that it will neutralise this through scale benefit and higher internal cash generation. Though hyper-competition continues as of now, going ahead, the company expects prices for both voice and data to increase.

While subscribers increased five per cent, voice volumes were up by a sharp nine per cent, whereas data volumes continued to be strong, up 18 per cent over the December quarter. Revenue growth would have been higher but for the reduction in interconnect usage charge from 20 paise to 14 paise. The impact of the same on the revenues was pegged at Rs 105 crore by the company. Like-to-like revenue growth is stated at 6.3 per cent.

Net profit for the quarter was up 59 per cent sequentially to Rs 1,077 crore while on a consolidated basis (including Indus Towers) it was up 23 per cent to Rs 941 crore, better than estimates that pegged it at Rs 831 crore. The stand-alone net profit includes dividend of Rs 160 crore.

While volume growth has been strong, pricing power is yet to show up though there has been talk of the same for some time now. For the third successive quarter, the company’s average revenue per minute (ARPM) for voice services remained muted. For the March quarter, voice ARPM was down five per cent on a sequential basis to 33.9 paise. Data realisations too were down 4.4 per cent to 25.7 paise, but that was largely expected. Overall ARPM thus was down by 3.2 per cent to 44.8 paise. Thus blended RPM has fallen for the first time in four quarters.

Given the spectrum payment and cost of expanding its network (capex for FY16 pegged at Rs 5,000-5,500 crore) cost pressures will increase. But, the company has indicated that it will neutralise this through scale benefit and higher internal cash generation. Though hyper-competition continues as of now, going ahead, the company expects prices for both voice and data to increase.

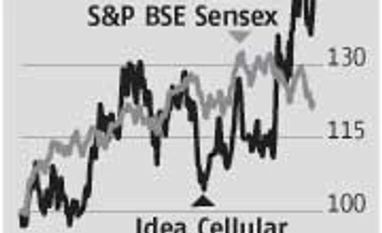

The stock was up 2.8% on Tuesday. Given that the results that came post market hours were ahead of estimates, it will be interesting to see how the Street reacts to the pressure on voice realisations.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Apr 28 2015 | 9:36 PM IST