Investors bet on USL shares on W&M sale

)

Investors are betting big on United Spirit's shares following an impending sale of its Whyte & Mackay business for up to $1.1 billion by next month.

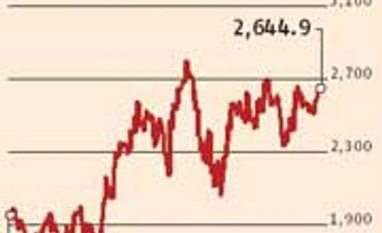

United Spirits shares were up 2.26 per cent on Thursday and almost 5 per cent this week as bankers say three global rival companies have already shown interest to buy out Whyte & Mackay, a subsidiary of USL. United Spirits shares are up 40% since January this year as new management led by Diageo took control over the company.

There was no confirmation from United Spirits on the suitors but a formal sale process will begin next month, say bankers. As per an undertaking given to UK's Office of Fair Trade by Diageo, it will have to sell W&M so that the latter can clear USL takeover. A decision by Diageo on the appointment of bankers for the sale of Whyte & Mackay is imminent. Diageo had taken over YSL in November last year for Rs 11,000 crore but the British competition commission has not yet cleared the sale.

Whyte & Mackay was acquired by USL's former owner Vijay Mallya at an enterprise valuation of $973 million in 2007 and analysts say the sale will fetch marginally higher than what Mallya had paid. If the sale of Whyte & Mackay goes through at around $ 1 billion to $1.1 billion, it will make USL a debt free company. A sale of W&M to private equity companies cannot be ruled out as in the recent past many PEs bought stake in liquor companies.

The sale of Whyte & Mackay is on the fast track after Diageo made an offer to the Office of Fair Trade (OFT) to sell most of its Whyte & Mackay business to address competition concerns on bottled blended Scotch whisky following its takeover of USL.

Both Diageo and W&M are major suppliers of bottled blended whisky to retailers, with W&M also being an important supplier of own-label blended whisky. The OFT found that there is substantial competition in the retail sector between Bell's whisky, a Diageo label, and Whyte & Mackay's own-label and branded blended whisky. The OFT found the merger may lead to reduced competition in the supply of blended whisky to retailers, leading to higher prices for retailers, and consumers.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Dec 20 2013 | 12:28 AM IST