New launches, rural uptick can revive Colgate's fortunes

While toothphate market share has stabilised, there is hope of a better show in the naturals portfolio where the company has been a late entrant

)

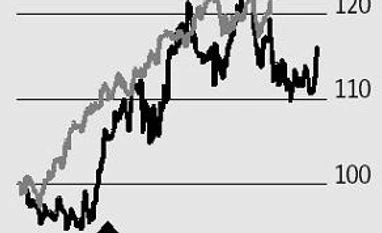

premium

After underperforming on the volume front and losing market share over the past few quarters, Colgate-Palmolive is expected to recover some of the volumes on the back of new launches, price cuts and uptick in rural demand. The company has lost about 400-basis point market share in the toothpaste category over the past two years, to 54 per cent, on account of minimal presence in the naturals segment as well as stiff competition from early entrants Patanjali and Dabur. Analysts at Motilal Oswal Securities said the sequential trends indicate a gradual stabilisation in the market share of Colgate, the leader in India's toothpaste industry.

As Colgate starts making inroads into the naturals segment, it should help the company get back on the growth path. The launch of Colgate Swarna Vedshakti, the second brand under the Vedshakti portfolio, coupled with a slew of launches to be rolled out will help the company emerge as a strong player in the herbal/naturals/ayurvedic sub-segment. These segments now form about 25 per cent of the overall toothpaste market. The naturals toothpaste market is the fastest growing segment, and is expected to account for about 30 per cent of the toothpaste market by the end of FY18.

The other trigger is the momentum from the recovery in the rural segment, where the company has a stronger presence than competitors such as Hindustan Unilever and Patanjali. Barring the slowdown between FY14 and FY17 due to poor monsoons and demonetisation, the company has reported strong double-digit growth led by rural volumes. Government policies aimed at boosting the rural economy and incomes, coupled with normal monsoons are expected to boost consumption of oral care products.

As Colgate starts making inroads into the naturals segment, it should help the company get back on the growth path. The launch of Colgate Swarna Vedshakti, the second brand under the Vedshakti portfolio, coupled with a slew of launches to be rolled out will help the company emerge as a strong player in the herbal/naturals/ayurvedic sub-segment. These segments now form about 25 per cent of the overall toothpaste market. The naturals toothpaste market is the fastest growing segment, and is expected to account for about 30 per cent of the toothpaste market by the end of FY18.

The other trigger is the momentum from the recovery in the rural segment, where the company has a stronger presence than competitors such as Hindustan Unilever and Patanjali. Barring the slowdown between FY14 and FY17 due to poor monsoons and demonetisation, the company has reported strong double-digit growth led by rural volumes. Government policies aimed at boosting the rural economy and incomes, coupled with normal monsoons are expected to boost consumption of oral care products.