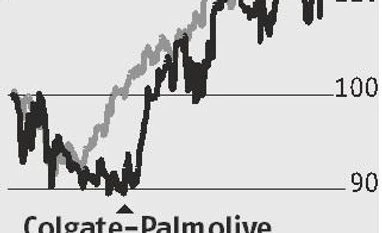

No ayurvedic relief for Colgate yet

Firm hoping to arrest decline with launch of Swarna Vedshakti

)

premium

Colgate Palmolive’s results for the September quarter (Q2) seem to be a mixed bag, and there are reasons for the Street to worry.

Revenues grew 2.7 per cent year-on-year (y-o-y) to Rs 1,078 crore, aided by a better price and product mix, while volumes fell 0.9 per cent. But, analysts had estimated revenue growth of four per cent, aided by volume growth of one-two per cent and price/mix impact of two-three per cent, for the quarter. The company indicated that wholesale demand was soft at the start of Q2 (due to the goods and services tax transition), but it expects demand to pick up gradually.

Its performance at the net profit level, though, was in line with estimates, as the bottom line (adjusted for tax reversals) was up five per cent over the year-ago quarter, at Rs 177 crore. Operating profit at Rs 300 crore was over nine per cent higher than the year-ago quarter, while margins at 27.7 per cent was 170 basis points (bps) higher. The performance was led by lower advertising and promotions costs, which as a percentage of revenues fell 110 bps. Raw material costs and other expenses, too, were down 40-80 bps, which helped offset some of the pressures on account of higher employee costs.

Revenues grew 2.7 per cent year-on-year (y-o-y) to Rs 1,078 crore, aided by a better price and product mix, while volumes fell 0.9 per cent. But, analysts had estimated revenue growth of four per cent, aided by volume growth of one-two per cent and price/mix impact of two-three per cent, for the quarter. The company indicated that wholesale demand was soft at the start of Q2 (due to the goods and services tax transition), but it expects demand to pick up gradually.

Its performance at the net profit level, though, was in line with estimates, as the bottom line (adjusted for tax reversals) was up five per cent over the year-ago quarter, at Rs 177 crore. Operating profit at Rs 300 crore was over nine per cent higher than the year-ago quarter, while margins at 27.7 per cent was 170 basis points (bps) higher. The performance was led by lower advertising and promotions costs, which as a percentage of revenues fell 110 bps. Raw material costs and other expenses, too, were down 40-80 bps, which helped offset some of the pressures on account of higher employee costs.