Slowdown hits Essar Steel hard

CARE downgrades firm to default grade

)

Essar Steel has been hit by the macroeconomic uncertainty. The company is finding it difficult to service its debt, prompting CARE Ratings to downgrade the company's long-term rating to 'default', the lowest rating among India's leading primary steel makers.

"CARE downgraded Essar Steel's long- and short-term bank facilities from BBB-, reflecting the delays in servicing debt obligations by the company on account of its weakened liquidity position, as a result of continuing net losses," the ratings agency said. The rating agency attributed this to a steady decline of the company's liquidity position, owing to a sharp fall in operating profits. The company's interest liability continued to be in line with the rise in its borrowings and rising interest rates.

CARE Ratings said at this rate, the company would either need fresh capital infusion by promoters or it would have to sell some of its assets.

For the year ended March this year, the company recorded a net loss of Rs 2,784.94 crore, on a standalone basis. Operating profit stood at just Rs 475.76 crore, a fraction of its interest liability of Rs 3,139.88 crore. On a consolidated basis, the company recorded an operating loss of Rs 1,651.91 crore; interest payout stood at Rs 2,954.7 crore.

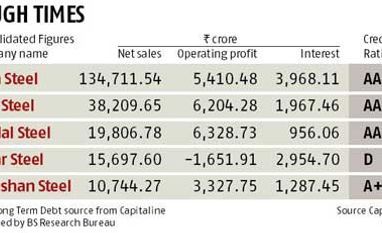

Essar Steel's peers seem to be managing their businesses more efficiently, evident from their profit-and-loss statements for the year ended March, despite the rising debt. On a consolidated basis, Tata Steel's interest payout during the period stood at Rs 3,968.11 crore, against an operating profit of Rs 5,410.48 crore. The operating profit of Jindal Steel & Power was also much higher, at Rs 6,328.73 crore; its the interest outgo stood at Rs 956.03 crore.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Oct 04 2013 | 12:27 AM IST