Sovereign funds of West Asia get aggressive on India

)

If the plunge in crude oil prices was expected to dampen West Asia-based sovereign funds' ability to make large investments, it is not reflected in India yet. It has enthused their interest as they shift their focus from European markets to emerging ones, where returns are better.

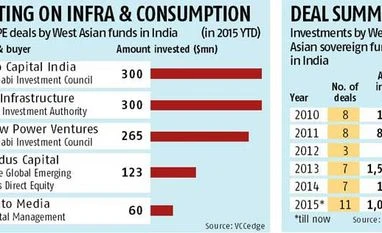

Last week, Kuwait Investment Authority invested $300 million in debt-laden GMR Infrastructure by subscribing to foreign currency convertible bonds. Abu Dhabi Investment Council made two large investments in the year - $300 million in Altico Capital, a non-banking financial company which lends to realty players, and $265 million in ReNew Power.

Year 2015 has, so far, seen $1.09-billion investment by funds from West Asia, the second highest after the record $1.5 billion invested in 2013. Most of them are from sovereign wealth funds or family offices. "A number of them are looking at core sectors for investment in India (specifically real estate and infrastructure) where they are taking longer term bets," says Sanjeev Krishan, partner and leader, private equity & transaction services, at PricewaterhouseCoopers India.

This year, the Brent crude is down 28 per cent to $40.18 a barrel. This has naturally impacted funding of sovereign funds from West Asia governments, whose earnings are largely dependent on crude prices. After years of ever-increasing allocations, sovereign fund managers are adjusting to a low-oil environment that might persist for several years. Sovereign funds in West Asia control one-fourth of the $7.09-trillion global sovereign wealth funds.

"It may be noted that a number of them stayed away from India in the past, and focused on the MENA (Middle East and North Africa regions) and are using the depressed valuations and their ability to hold on to investments longer as key reasons for their India focus," says Krishan.

West Asia sovereigns target average returns of nine per cent. These sovereign funds are finding it difficult to achieve this in European markets going through an economic crisis. Besides, they are not able to find enough opportunities in the MENA region.

Infrastructure, especially in emerging markets, is their growing area of interest as it provides annuity income. This has benefited indebted Indian companies. If the oil price environment persists, there is a growing recognition that local governments might need to tap into fund assets to finance sizeable spending programmes to deliver their economic growth plans. In such a case, assets that can provide annuity income would come handy to the local governments.

"The interest in India infrastructure, especially some segments like renewable energy, roads and airports, is buoyed by positive action from the government in the respective segments, rupee depreciation which has made investments more attractive and the deleveraging efforts of the Indian companies," says Mayank Rastogi, partner, EY.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Dec 10 2015 | 12:07 AM IST