Weak demand from original equipment manufacturers to weigh on Apollo Tyres

Falling raw material costs to ease the pressure on pricing, sluggish demand

)

premium

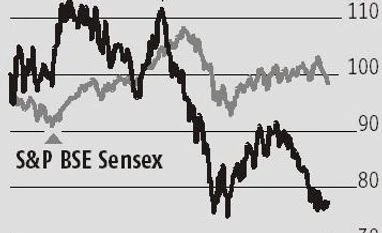

The Apollo Tyres stock is down 14 per cent since the start of the month on worries of rising competitive pressures, slowing demand from automakers and lower-than-expected December quarter numbers.

Revenues in the quarter did not grow as anticipated due to volume growth, which failed to meet expectations both in domestic as well as international businesses. Margins, which were impacted by higher raw material costs, were down by 100 basis points to 11.2 per cent.

The key worry is weak demand from original equipment manufacturers (OEMs) or automakers, which account for 30 per cent of its sales. Given the slowing sales in the auto sector, the company rolled back price increases it had taken at the end of November 2018.

Revenues in the quarter did not grow as anticipated due to volume growth, which failed to meet expectations both in domestic as well as international businesses. Margins, which were impacted by higher raw material costs, were down by 100 basis points to 11.2 per cent.

The key worry is weak demand from original equipment manufacturers (OEMs) or automakers, which account for 30 per cent of its sales. Given the slowing sales in the auto sector, the company rolled back price increases it had taken at the end of November 2018.