Amendments to Companies Act dilute 2013 law's strictness

Eases penal provisions, dilutes RPT approval procedures, bars public inspection of most board resolutions - all justified as aiding the ease of doing business

)

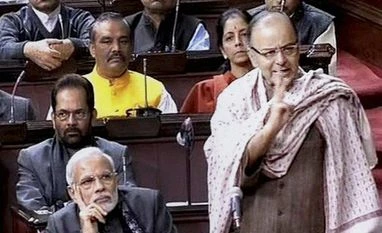

Prime Minister Narendra Modi with Union Finance Minister Arun Jaitley in the Rajya Sabha during the Parliament's winter session in New Delhi on Thursday. Minister of State Mukhtar Abbas Naqvi is also seen

In amendments cleared by the Lok Sabha on Wednesday to soften the Companies Act, only those officials of a firm who're accused of serious crimes such as duping the public or shareholders will have to undergo the harsh process of seeking bail.

Under the present Act, enacted only last year, the stringent process of applying for bail was for a variety of charges. Concerned that such penal provisions affect the ease of doing business in India, the government has sought to limit these provisions to serious offences.

It has inserted a provision of making bail procedures harsh only if fraud is committed, under Section 447 of the Act. Generally, an accused gets bail by applying to a court. The present Act made the process tougher; the public prosecutor first presents his case and the judge needs to be convinced that the accused will not commit any crime while on bail. "It is almost like starting the hearing even before the case starts," complained a senior company professional.

Also Read

Also under the present Act, there are many provisions which indirectly refer to Section 447 in the case of some violation. This is henceforth sought to be confined to only crimes committed under Section 447. Here, fraud is defined as any irregularity in the company committed with intent to deceive the company or its shareholders or its creditors or any person, whether or not there is any wrongful gain or wrongful loss.

"Instead of applying this in a convoluted manner, the government has brought some clarity," said Sai Venkateshwaran, partner and head of accounting advisory services at KPMG in India.

Any person found guilty of such fraud would be punishable with imprisonment of not less than six months, extendable to 10 years. He or she will also be liable to a fine, at least equal to the amount involved in the fraud but also extendable to three times as much. Where the fraud in question involves the public interest, the term of imprisonment will not be less than three years, according to the section.

Arun Jaitley, the corporate affairs minister, said in the Lok Sabha on Wednesday that some such provisions in the existing Act would have made doing business in India extremely difficult and the investment environment would be disrupted. "A terrorist can get bail but a company official cannot," he had said.

As Section 447 is open to subjective interpretation, some company officials said the government had actually not given major relief to companies. "It has only given a clarification," said the senior company professional quoted earlier. No action had been taken so far under these harsher provisions, he added.

The government has also tried to reduce the load on judges. In the amendments, 'winding up' cases on companies is to be heard by a two-member bench, instead of a three-member one. Also, special courts will be involved only in cases where the accused is charged with offences punishable by two years imprisonment or more. Section 8 of the Act, on rules related to licensing and establishment of a company, is one example where imprisonment extends up to three years for a breach.

RPTs

The amendments include replacing 'special resolution' with 'ordinary resolution' for approval of related-party transactions (RPTs) by minority shareholders. This means companies only need to have the consent of 50 per cent of the minority shareholders present, instead of the 75 per cent prescribed under current law.

Recently, a special resolution moved by liquor giant United Spirits through a postal ballot to approve four RPTs was defeated by minority shareholders, in line with the 2013 law. Against the 75 per cent of favourable votes required, the resolution garnered 70.2 per cent. The proposed amendments would have enabled the resolution to go through.

The new amendment also empowers the board of directors' audit committee to give omnibus approvals for RPTs on an annual basis. The Bill's accompanying statement says this is in line with the Securities and Exchange Board of India's policy, and to increase the ease of doing business.

Heeding corporate demand, the proposed changes also exempt RPTs between holding companies and wholly owned subsidiaries from the requirement of minority shareholders' approval.

Outside scrutiny

The amendments also include a new provision which prohibit the public inspection of board resolutions filed with the registrar of companies. Company professionals have been complaining to the ministry of corporate affairs that board resolutions, if made public, would reveal company strategy, helping the competitors.

Jaitley had said this provision for public scrutiny wasn't followed in any other country. He had added it would be unwise to expect a company to alert its rivals by making public its board decision to, for instance, launch a new car model or a new trademark.

Resolutions adopted at annual general meetings alone would be open to public scrutiny.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Dec 20 2014 | 10:30 PM IST