Govt's cash balance with RBI high, puts stress on liquidity

Cash pile-up indicates Centre may be reluctant to spend in order to meet fiscal deficit target of 3.9% of GDP for 2015-16

)

The government's cash balance with the Reserve Bank of India (RBI) was Rs 1.4 lakh crore on January 28, an amount unusually high for this time of the financial year and is causing acute liquidity pressure in the banking system.

The cash pile-up indicates the Centre may be reluctant to spend in order to meet the fiscal deficit target of 3.9 per cent of the gross domestic product (GDP) for 2015-16.

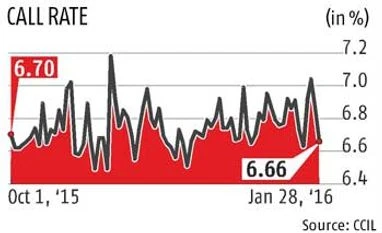

With government action plus RBI intervention in the foreign exchange (forex) market, liquidity shortage in the banking system has assumed mammoth proportion - prompting RBI to offer assistance of Rs 1.6 lakh crore through its overnight and dated liquidity windows so that call money rates remain near the repo rate of 6.75 per cent.

On a technical basis though, the liquidity shortage is 1.73 per cent of the net demand and time liabilities of the banking system, higher than RBI's own target of one per cent. However, the overarching aim of the regulator now is to keep call money rates anchored to the repo rate.

| TRIGGERS FOR ACUTE LIQUIDITY PRESSURES |

|

"We are looking at all measures to ensure there is sufficient liquidity and we are able to support what is required as far as the Budget is concerned," Minister of State for Finance Jayant Sinha said in response to a question on the government sitting on cash. "RBI is fully supportive of all requirements of liquidity and is standing by to provide whatever liquidity is necessary," Sinha said, in Mumbai on the sidelines of a banking conclave organised by industry body Assocham.

Analysts said government cash balance with RBI was usually around Rs 70,000 crore at this time of year. Finance ministry officials said while the Centre was not holding back on capital expenditure, there was a tightening over schemes where spending was weak in the first three quarters of 2015-16. "Other departments have been told that pending disbursement on revised estimates may occur after February. So that may have contributed to the additional cash," an official said.

The finance ministry has told the departments concerned that it might not support schemes in January-March that have not utilised funds in the first three quarters of the year. Schemes for the social sector and of national importance are, however, unlikely to be affected.

Officials said the finance ministry was not keen to release Rs 12,000 crore of the Rs 40,000 crore gross budgetary support for the railways citing poor pace of work. Sources from other ministries confirmed similar instructions from the finance ministry, which has not reacted positively to the foreign ministry's proposal for higher than its budgeted allocation. Banks usually face a liquidity shortage at the time of tax outflow but money starts coming back into the system when the government begins spending. This has not happened so far, indicating the government could be hunkering down to meet its deficit target. Banks are finding it difficult to meet higher demand for year-end credit from companies and enhanced liquidity reserve requirements. An executive with the State Bank of India (SBI) said most banks were struggling to meet the enhanced liquidity coverage ratio under Basel III norms. The obligation ruled out selling gilts, an SBI executive said. Foreign institutional investors were liquidating part of their holdings in Indian debt and taking out money, putting additional strain on liquidity, bank treasury executives said.

An executive with Andhra Bank said the RBI's intervention in the forex market was sucking out rupees. The RBI sold $5 billion in the past month to stabilise a falling rupee and removed an equivalent amount of money from the system.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Jan 30 2016 | 12:59 AM IST