FTIL exit should open a road for MCX

Recently FTIL announced selling its 15% stake in MCX to Kotak Mahindra Bank and now it is left only with 5%

)

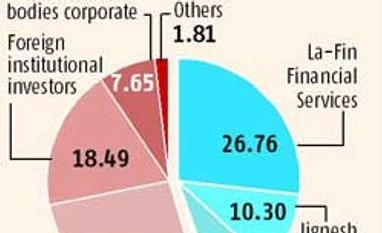

On Sunday evening, Financial Technologies (FTIL) announced it was selling a 15 per cent stake to Kotak Mahindra Bank, which would leave it with only five per cent in the country’s largest commodity exchange.

The Forward Markets Commission (FMC) had said it would approve no new proposals, including contracts, at MCX till FTIL began to get out. Ramesh Abhishek, chairman of MC, said: “Once it (the sale process by FTIL) goes through, we will consider proposals from MCX...non-compliance with this order (declaring FTIL not fit to run an exchange) had created a lot of regulatory issues, hampering MCX’s development and growth. Market confidence had also been a bit shaken on that account. However, now those issues will get sorted.”

According to an official in the know, a new technology contract between MCX and FTIL was still under negotiation. He hoped this would be completed very soon. Once this is done, another hurdle in the way for growth for MCX will be cleared.

MCX has also been without a properly designated managing director for about 10 weeks. The previous one had resigned on health grounds, after serving for only three months. Interviews for a new one are slated to take place on Tuesday; there are 16 candidates. Three of them, with experience or understanding of commodity infrastructure companies are said to have been shortlisted.

Sources in the know said that senior executives from depository, public sector banks, former executive from the Sebi, executives who have worked with power exchange and power trading company and even a former Mutual Fund CEO have applied. However managing directors of two stock exchanges one national and another regional have also applied. Interestingly there is a general preference for selecting someone who has commodity market experience and three candidates having experience or understanding of commodity infrastructure companies are also said to have been shortlisted.

Meanwhile, the MCX has investments in stock exchange MCX-SX and even in Dubai Gold and Commodities Exchange. With 15% stake, Kotak bank also holds indirect stake in these exchanges. MCX had earlier said that it wants to exit from all these ventures. In this regards, Kotak Mahindra Bank spokesperson however said that, "Prime consideration for the MCX transaction is their Indian commodities exchange business. We will however, be pure financial investors and have no say in their decision making on these other exchanges."

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Jul 22 2014 | 10:33 PM IST