Infosys' top line likely to pip peers' revenue

TCS seen clocking higher profit growth of 7%, followed by Infosys' 6.4%

)

The September quarter is likely to be a reasonably good one for most Indian information technology (IT) companies, owing to healthy demand trends. This is good news, considering HCL Technologies had recently given a revenue warning for the quarter, which led to concern on the Street about the performance of other IT giants. For now, the problem appears specific to HCL Tech.

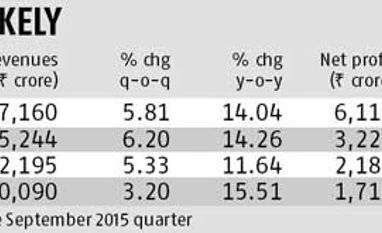

After a strong June quarter, Infosys is expected to outpace its peers. On an average, analysts expect the company to post 6.2 per cent sequential growth in rupee revenue, aided by healthy client mining. Ability to ensure the trend is sustained will help reinstate confidence among investors, as the company has lagged its peers, as well as the sector, for long. Though TCS’ revenue growth is also estimated to be strong, the performance of its Diligenta and energy businesses, which have hit the company’s revenue in recent quarters, will be closely watched.

Client-specific issues are seen eating into some of the revenue growth of HCL Tech and Wipro. Both could also see unfavourable cross-currency movement (Australian dollar, Brazilian real and the rupee vis-à-vis the US dollar) hit their performance for the quarter. For all companies, the Street would track the trend in realisations, given the intensifying pricing pressure for both Accenture and Cognizant.

On a like-to-like basis or measured in constant currency terms, revenue growth for all the four companies is seen at 1.8-4.6 per cent compared to the quarter ended June 2015, with Infosys leading and HCL Tech lagging peers.

Due to the revenue growth and company-specific issues, margin trends might be different. Earnings before interest, tax, depreciation and amortisation (Ebitda) margins are seen inching up, aided by the rupee’s depreciation and lower visa costs for the top two companies, with TCS and Infosys likely to record margin expansion of 50-100 basis points for the quarter. But wage increases could reflect on the margins of Wipro and HCL Tech, with latter seeing a greater impact due to a one-time revenue reversal during the quarter.

While Infosys is seen leading the pack on the revenue growth front, TCS is expected to lead at the net level, with its net profit estimated to grow seven per cent sequentially, aided by Ebitda margin expansion. TCS’ diversified revenue model, relatively stable pricing and focus on improving revenue per employee augur well for its margins. Infosys’s net profit is likely to grow 6.4 per cent. It s profit growth could vary, depending on the how soon various efficiency measures bear fruit. While Wipro is seen reporting flattish profit, that of HCL Tech is estimated to slip 3.2 per cent sequentially.

The commentary on outlook is crucial. Analysts believe Infosys will maintain its FY16 constant-currency revenue growth forecast of 10-12 per cent. Earlier, the Wipro management had indicated it expected growth to gain momentum in the second half of this financial year. Analysts expect the company to forecast constant-currency revenue growth of two-four per cent for the December quarter. The outlook for the energy vertical and the company’s strategy in the digital business will also be tracked. Wipro has been lagging peers for some time and the management’s road map to catch up will be important. For HCL Tech, growth potential in the IMS business will be keenly watched. Commentary around pricing trends and digital strategy will be important for all the companies.After a strong June quarter, Infosys is expected to outpace its peers. On an average, analysts expect the company to post 6.2 per cent sequential growth in rupee revenue, aided by healthy client mining. Ability to ensure the trend is sustained will help reinstate confidence among investors, as the company has lagged its peers, as well as the sector, for long. Though TCS’ revenue growth is also estimated to be strong, the performance of its Diligenta and energy businesses, which have hit the company’s revenue in recent quarters, will be closely watched.

Client-specific issues are seen eating into some of the revenue growth of HCL Tech and Wipro. Both could also see unfavourable cross-currency movement (Australian dollar, Brazilian real and the rupee vis-à-vis the US dollar) hit their performance for the quarter. For all companies, the Street would track the trend in realisations, given the intensifying pricing pressure for both Accenture and Cognizant.

On a like-to-like basis or measured in constant currency terms, revenue growth for all the four companies is seen at 1.8-4.6 per cent compared to the quarter ended June 2015, with Infosys leading and HCL Tech lagging peers.

Due to the revenue growth and company-specific issues, margin trends might be different. Earnings before interest, tax, depreciation and amortisation (Ebitda) margins are seen inching up, aided by the rupee’s depreciation and lower visa costs for the top two companies, with TCS and Infosys likely to record margin expansion of 50-100 basis points for the quarter. But wage increases could reflect on the margins of Wipro and HCL Tech, with latter seeing a greater impact due to a one-time revenue reversal during the quarter.

While Infosys is seen leading the pack on the revenue growth front, TCS is expected to lead at the net level, with its net profit estimated to grow seven per cent sequentially, aided by Ebitda margin expansion. TCS’ diversified revenue model, relatively stable pricing and focus on improving revenue per employee augur well for its margins. Infosys’s net profit is likely to grow 6.4 per cent. It s profit growth could vary, depending on the how soon various efficiency measures bear fruit. While Wipro is seen reporting flattish profit, that of HCL Tech is estimated to slip 3.2 per cent sequentially.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Oct 05 2015 | 10:42 PM IST