Mkts end at record high: Sensex up 435 pts, ends above 33K, Nifty at 10,295

All that happened in the market today

)

Source: NSE

Benchmark indices ended the day at fresh highs with Nifty settling above 10,300 for the first time ever and Sensex above 33,000 following a mega recapitalisation package for banks and a Rs 7 lakh crore infra booster ahead of October F&O expiry.

With economic revival being big on the agenda, the government on Tuesday unveiled a Rs 2.11-lakh crore support for public sector banks (PSBs), struggling with mounting bad loans, in order to spur “genuine” infrastructure lending for upcoming mega projects.

The government will pump in Rs 1.35 lakh crore of this recapitalisation through bonds. Another Rs 76,000 crore will come from budgetary support and banks tapping the market.

Globally, the shares were trading mixed. The MSCI world equity index which tracks shares in 47 countries, was flat as a muted open in Europe counterbalanced earlier gains in Asia.

MSCI’s broadest index of Asia-Pacific shares outside Japan ended the session up 0.1% as India, South Korea and Indonesia all hit record highs.

3:50 PM

Market rundown by Vinod Nair, Head of Research of Geojit Financial Services

"Market touched a new high led by the Government’s ideal plan to fix the credit growth and lack of private investment in the country, which was a key drag on the broad economic system. Ultimately it is giving a remedy to the NPA issues and capital adequacy of banks, which is an essential for credit growth."

3:48 PM

Nifty Infra at 7-year high

Source: NSE

3:40 PM

Nifty Bank gained 3%

Source: NSE

3:38 PM

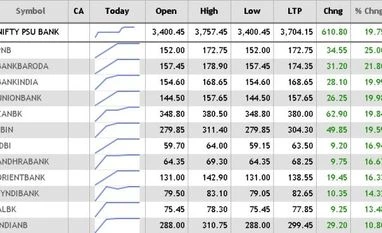

PSU Banks rally

Source: NSE

3:36 PM

Top Sensex gainers and losers

Source: BSE

3:35 PM

Broader Markets

Broader markets underpeerformed the benchmark indices with BSE midcap index up 0.4% and BSE Smallcap index down 0.2%

Broader markets underpeerformed the benchmark indices with BSE midcap index up 0.4% and BSE Smallcap index down 0.2%

3:33 PM

Markets at Close

The Indian market soared to a fresh record high on Wednesday as investors cheered mega recapitalisation package for banks and a Rs 7 lakh crore infra booster ahead of October F&O expiry.

The Indian market soared to a fresh record high on Wednesday as investors cheered mega recapitalisation package for banks and a Rs 7 lakh crore infra booster ahead of October F&O expiry.

S&P BSE Sensex ended over 33,000 for the first time ever. The index settled at new closing high of at 33,042 up 435 points for the day. Nifty50, on the other hand, also achieved new milestone, ending at fresh closing high of 10,295, up 87 points.

3:21 PM

Sectoral Trend

Source: NSE

3:11 PM

Infosys Q2 results: Wealth creation story of large IT stocks is over

Infosys’ Q2FY2018 results are in line with the large peers in the industry – year-on-year growth in revenues and net profit stand at 1.5% and 3.3% respectively. TCS and Wipro have also posted poor single digit yoy growth in revenues or profits.

It is quite unfortunate that three key issues have been impacting the large IT companies including Infosys – first of all the ‘base effect’. Today India’s IT export basket of nearly $110 billion cannot maintain the kind of growth momentum the industry used to maintain in 1990s or a decade ago. IT export growth also got impacted by growing restrictive practices from the US government.

The problems of the industry further compounded by appreciation of rupee in 2017 – so far in this year, rupee has appreciated by 4.5%. Such significant appreciation of currency has partly led not only to Infosys’ revenue in rupee terms growing in poor single digit, but also significantly lower than the dollar revenue growth. READ MORE

3:01 PM

Market Check

| Index | Current | Pt. Change | % Change |

| S&P BSE SENSEX | 33,054.06 | +446.72 | +1.37 |

| S&P BSE SENSEX 50 | 10,685.35 | +96.55 | +0.91 |

| S&P BSE SENSEX Next 50 | 35,364.55 | +401.86 | +1.15 |

| S&P BSE 100 | 10,709.00 | +100.65 | +0.95 |

| S&P BSE MidCap | 16,209.32 | +27.59 | +0.17 |

2:53 PM

Edelweiss on Jindal Stainless (Hisar)

Rating - BUY

CMP - Rs 205

Target - Rs 329

We expect company's net sales/EBIDTA/PAT to grow at a CAGR of 15%/19%/46% respectively between FY17-19E We believe, higher RoCE of JSHL (22%) (even on WACC adjusted basis) compared to European players (8-10%), burnished demand prospects and market leadership should lead to at par/premium valuation for the company with respect to European players. We are valuing the stock at par with European listed counterparts at 7x EV/EBIDTA, yielding

value of Rs 289/share. Additionally, we value the company’s investments in JSL (36.5% stake) at Rs 41/share to arrive at target price of Rs 329.

2:44 PM

Why Murthy-Nilekani clash is unlikely at Infosys

In his outburst against the Infosys board, led by his protégé Nandan Nilekani, Infosys co-founder N R Narayana Murthy has hinted that the issue of governance failure he had earlier raised during Vishal Sikka’s tenure would be buried forever.

It is unlikely that the founders will get into a public spat like the Murthy-Seshasayee one earlier. Nor will Seshasayee, given his statement that bringing stability back at Infosys is priority. Sikka, who has signed a non-disparagement agreement with Infosys, has also remained silent.

Nilekani, who knows Murthy all too well, has already bought peace with his former boss. READ MORE

2:30 PM

Pharma index slips over 1% in an otherwise firm market

Source: NSE

2:13 PM

PSU Bank index hits 52-week high; market-cap up by Rs 1.1 lakh crore

Nifty PSU Bank index hit a 52-week high of 3,980, surging 29% in intra-day trade on the National Stock Exchange (NSE) on strong rally in state-owned banks after the government cleared Rs 2.11 lakh crore bank recapitalisation plan.

The combined market capitalization (market-cap) rose by over Rs 1-lakh crore in single day, post a huge rally in PSU Banks. India’s largest lender SBI and other PSU lenders in terms of market-cap added nearly Rs 1.10-lakh crore to stock investors’ wealth. READ MORE

Nifty PSU Bank index hit a 52-week high of 3,980, surging 29% in intra-day trade on the National Stock Exchange (NSE) on strong rally in state-owned banks after the government cleared Rs 2.11 lakh crore bank recapitalisation plan.

The combined market capitalization (market-cap) rose by over Rs 1-lakh crore in single day, post a huge rally in PSU Banks. India’s largest lender SBI and other PSU lenders in terms of market-cap added nearly Rs 1.10-lakh crore to stock investors’ wealth. READ MORE

1:56 PM

Slips in trade

KIOCL was locked in 5% lower circuit at Rs 282.90 at 13:15 IST on BSE, with the stock declining on profit booking after logging gains in prior six trading days.

KIOCL was locked in 5% lower circuit at Rs 282.90 at 13:15 IST on BSE, with the stock declining on profit booking after logging gains in prior six trading days.

Topics :

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Oct 25 2017 | 3:30 PM IST