Sensex at five-week low; Nifty settles at 9,710, down 350 pts for the week

All that happened in Friday's session

)

n

The markets settled at their five-week lows as PSU banks and metal stocks tanked, while escalating tensions between the United States and North Korea continued to drive investors away from risk assets.

The Nifty PSU Bank index dipped nearly 5% after Oriental Bank, Union Bank of India and State Bank of India fell 5% each post disappointing earnings for the June quarter. Meanwhile, volatility index India VIX hit its highest in six months, suggesting market participants expect major volatility on the Nifty over the next thirty days.

Overseas, global markets tumbled for a fourth day and were on course for their worst week since November, as the escalating war of words over North Korea drove investors on Friday toward the yen, the Swiss franc and gold.

Europe's main London, Frankfurt and Paris markets started between 0.5 and 1.1% lower and Germany's ultra-safe 10-year government bonds were trading at their highest prices since June.

4:19 PM

Anand James, Chief Market Strategist, Geojit Financial Services

Though Sebi’s softened stance on shell companies revived midcap stocks, volatility persisted keeping risk appetite under check. VIX soared over 15 for the first time in 6 months, as anxiety prevailed over the aggravating tensions between the US and North Korea, and investors were largely cautious ahead of the weekend. IIP and CPI numbers due shortly should offer the markets some distraction. Investors would be keeping their eyes on escalating tensions on the Korean peninsula for its impact on neighbouring economic powerhouses.

3:53 PM

Sectoral trend

PSU banks and metal stocks shed the most.

PSU banks and metal stocks shed the most.

Source: NSE

3:51 PM

Nifty Pharma bucks trend

Nifty Pharma (up 0.1%) was the sole sectoral gainer among NSE indices. All but two pharma stocks ended in green. CLICK HERE TO TRACK INDEX

Nifty Pharma (up 0.1%) was the sole sectoral gainer among NSE indices. All but two pharma stocks ended in green. CLICK HERE TO TRACK INDEX

3:44 PM

Top Sensex gainers and losers

Source: BSE

3:41 PM

Markets breadth negative

Market breadth depicted weakness. There were more than two losers against every gainer on BSE. 1,530 shares fell and 1000 shares rose. A total of 129 shares were unchanged.

Market breadth depicted weakness. There were more than two losers against every gainer on BSE. 1,530 shares fell and 1000 shares rose. A total of 129 shares were unchanged.

3:39 PM

Broader markets outperform

The BSE Midcap (down 0.2%) was down marginally, while the BSE Smallcap settled nearly unchanged.

The BSE Midcap (down 0.2%) was down marginally, while the BSE Smallcap settled nearly unchanged.

3:38 PM

Markets at close

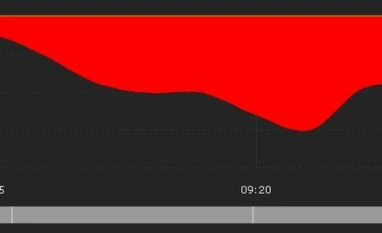

The Sensex settled at 31,213, down 317 points, while the broader Nifty50 closed at 9,710, down 109 points.

The Sensex settled at 31,213, down 317 points, while the broader Nifty50 closed at 9,710, down 109 points.

3:30 PM

3:26 PM

Earnings impact

SBI tumbles as much as 5.9% post Q1 results as bad loans soar. CLICK HERE FOR THE STORY

SBI tumbles as much as 5.9% post Q1 results as bad loans soar. CLICK HERE FOR THE STORY

3:19 PM

39 stocks from BSE 500 index hit 52-week lows

Markets have been on a downward spiral since August 1 when the S&P BSE Sensex ended at a record high of 32,575 levels. Since then, the index has tanked 4.2%, or around 1,381 points in past eight trading sessions. CLICK HERE TO READ MORE

Topics :

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Aug 11 2017 | 3:36 PM IST