MFs on record buying spree as valuations look stretched

Funds net buyers for 26 straight sessions, one of the longest spells in history

)

premium

graph

Last Updated : Jul 18 2017 | 2:38 AM IST

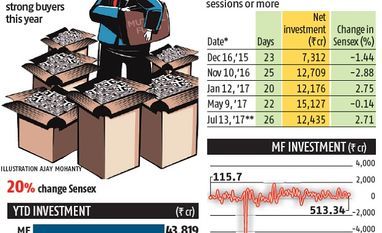

Domestic mutual funds (MFs) have been net buyers for 26 consecutive trading sessions, one of the longest unbroken buying sprees, even as the markets trade at lifetime high levels. Since June 7, equity funds have poured in Rs 12,435 crore, at a daily average of nearly Rs 500 crore. During the same period, foreign institutional investors (FIIs) have invested Rs 6,565 crore in Indian stocks.

The strong portfolio flows have come at a time when the domestic markets are above their long-term trading averages, potentially creating a valuation bubble.

The Sensex now trades at 20 times its estimated one-year forward earnings, the most in seven years and above the long-term average of around 17 times. Market participants say fund managers are being forced to buy even at current levels due to a flurry of inflows. The aggressive buying by MFs is on the back of robust flows into equity schemes in the past three months. Since April, equity oriented schemes have received investor flows of Rs 30,000 crore.

“Fund managers do not have the luxury of sitting on cash. They have to find investment options. Hence, they are continuing to invest even though the markets are looking a bit expensive. In fact, such persistent buying by the MFs has stretched the valuations of equities further. If earnings recovery does not happen as anticipated, there could be some serious implications for the markets,” said UR Bhat, managing director, Dalton Capital Advisors.

MFs have been buyers for 20 straight trading sessions on more than one occasion in the recent past. However, the latest 26-day buying spree is expected to topple the previous record of 29 straight buying sessions in October 2014.

“Fund managers are cognisant of the fact that they are buying expensive. However, they expect corporate earnings to enter a high growth phase, which will normalise valuations. Most investment experts, therefore, are advising investors to take a three to five years’ view,” said the CEO of a fund house.

Experts say any disappointment on the earnings recovery front could be an overhang on the markets.

Analysts have already cautioned that earnings recovery could be two or three quarters away as the newly introduced goods and services tax (GST) could have a short-term pull on the bottom lines of various companies.

“Despite the positive macro-factors, in the near-term there will be several sector-specific headwinds. Hence, the period will be lacklustre from the earnings growth perspective. A prolonged GST-led disruption and higher credit costs could be the key headwinds,” said Gautam Duggad, head of institutional equities, Motilal Oswal Financial Services.

However, a section of market experts still recommend buying at current valuations given the long-term potential of the market and the economy. Ridham Desai, head of India research, Morgan Stanley, says the Indian markets are still a good bet from a three to four year perspective.

“While the market appears to believe in a growth turn, it is far from pricing in a multi-year growth cycle, implying significant upside potential. Valuations are not signaling excesses. Indian stocks are attractive relative to US equities and local bonds and are in line with history on both an absolute as well as a relative basis,” he said in a recent note.

At this point of time, there also seems to be a strategic shift in the role of MFs in the Indian markets. In the last few years, mutual funds have emerged as a strong counter-balance to foreign institutions and now have assets under management worth Rs 5.25 lakh crore. However, there are concerns that if these fund houses do not make better returns than other asset classes, there could be a redemption spree as witnessed between 2010 and 2014.