Most trends appear to be positive

)

There was a huge surge of buying yesterday after Morgan Stanley recommended going overweight on Indian equities. This came after several downbeat sessions. As a result, expiry should come with a fair amount of optimism attached. However, despite the Morgan Stanley advisory, the global sentiment is not all that strong. The minutes from the last meeting of the Federal Open Markets Committee in late April make it clear that the Fed is now prepared to raise rates. It may even do so at the next meeting in mid-June.

Corporate data show a pattern of nominal increase in revenue with a significant fall in net profits. Banks are still taking a beating and liable to continue booking losses due to provisioning for non-performing assets. The macro-economic data is average with inflation rising, exports shrinking and industrial production almost flat. Hopes are riding mainly on the prospects of a super-normal monsoon.

Although the Nifty has risen above its own 200-DMA, it is not decisively clear of the 200-DMA yet. Nor has it clearly registered other bullish signals such as higher highs on the priceline. However if the index does beat 7,990, it will log higher highs. But, the long-term trend tentatively appears to be positive and so do the short-term and medium-term trends. Breadth and volume indicators also look positive. The net institutional attitude has been moderately positive through May. The Domestic institutions have bought enough to more than counter-balance FII selling. The retail sentiment also seems positive going by the excellent breadth.

The Nifty Bank also seems to have made a breakout, which has pulled it up till the 17,000 level. This is despite the massive losses of PSU banks due to high provisioning. The Nifty Bank is high-beta and a strangle with a long June 16,500p (215), long June 17,500c (190) is nearly zero-delta with the Nifty Bank at 16,997. This strangle costs 407 and it has breakevens at roughly 16,095, 17,905. breakeven at either end could be hit with just three big trending sessions and the next settlement should generate enough volatility to ensure that.

Open interest (OI) and the put-call ratios (PCRs) are both unreliable at this stage of the settlement. But, both look positive for what it is worth. The PCRs are above 1 for both the May series and the three month series. In the June series, OI peaks in the calls at 8,000c with another big peak at 8,200c and reasonable OI till 9,000c. OI is the June put series peaks at 7,700p but there's plenty of OI down till 7,000p.

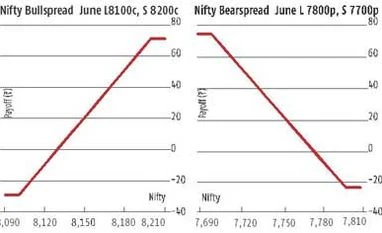

The Nifty closed at 7,935 on Wednesday. Given the new settlement, and the surge, it makes sense to look at wide spreads. A bullspread of long June 8,100c (76) short 8,200c (47) costs 29 and pays a maximum 81 and it's about 165 points from the money. A long June 7,800p (82), short 7,700c (57) costs 25 and pays a maximum 75, with the strike at 135 from money. These two spreads could be combined to create a set of one long strangle -one short strangle. It has a negative payoff of 46 versus a cost of 54.

A trader who doesn't expect too much movement in the next two or three sessions could consider inverting this sort of wide strangle, taking a short 8,100c, short 7,800p, long 7,700p, long 8,200c, etc. The position could be reversed with some profit if the market does not move much in the next two three sessions. As such, the perspective seems bullish but sentiment could go suddenly negative if the Fed seems to be getting more hawkish.

Corporate data show a pattern of nominal increase in revenue with a significant fall in net profits. Banks are still taking a beating and liable to continue booking losses due to provisioning for non-performing assets. The macro-economic data is average with inflation rising, exports shrinking and industrial production almost flat. Hopes are riding mainly on the prospects of a super-normal monsoon.

Although the Nifty has risen above its own 200-DMA, it is not decisively clear of the 200-DMA yet. Nor has it clearly registered other bullish signals such as higher highs on the priceline. However if the index does beat 7,990, it will log higher highs. But, the long-term trend tentatively appears to be positive and so do the short-term and medium-term trends. Breadth and volume indicators also look positive. The net institutional attitude has been moderately positive through May. The Domestic institutions have bought enough to more than counter-balance FII selling. The retail sentiment also seems positive going by the excellent breadth.

Open interest (OI) and the put-call ratios (PCRs) are both unreliable at this stage of the settlement. But, both look positive for what it is worth. The PCRs are above 1 for both the May series and the three month series. In the June series, OI peaks in the calls at 8,000c with another big peak at 8,200c and reasonable OI till 9,000c. OI is the June put series peaks at 7,700p but there's plenty of OI down till 7,000p.

The Nifty closed at 7,935 on Wednesday. Given the new settlement, and the surge, it makes sense to look at wide spreads. A bullspread of long June 8,100c (76) short 8,200c (47) costs 29 and pays a maximum 81 and it's about 165 points from the money. A long June 7,800p (82), short 7,700c (57) costs 25 and pays a maximum 75, with the strike at 135 from money. These two spreads could be combined to create a set of one long strangle -one short strangle. It has a negative payoff of 46 versus a cost of 54.

A trader who doesn't expect too much movement in the next two or three sessions could consider inverting this sort of wide strangle, taking a short 8,100c, short 7,800p, long 7,700p, long 8,200c, etc. The position could be reversed with some profit if the market does not move much in the next two three sessions. As such, the perspective seems bullish but sentiment could go suddenly negative if the Fed seems to be getting more hawkish.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: May 25 2016 | 10:44 PM IST