Recent rise in bond yields could spoil growth party for retail NBFCs

Their cost of funds was up 40 basis points year-on-year during the first half of FY18, and could rise further as bond yields continue to head north

)

premium

The recent rise in bond yields could spoil the growth party for retail non-banking finance companies (NBFCs). Retail NBFCs such as Housing Development Finance Corporation (HDFC), LIC Housing, Indiabulls Housing and Bajaj Finance, among others. The sector was one of the key beneficiaries of low bond yields and interest rates in the past three years, but now that yields are rising, the companies are likely to see a compression in their net interest margins (NIMs), translating into lower profitability.

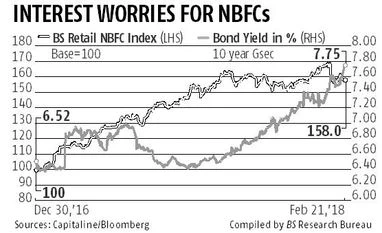

NBFCs' cost of funds was up 40 basis points (bps) during the first half of FY18 over the last fiscal year and analysts see its rising further as bond yields continue to head north. Yields on government of India 10-year bonds are up nearly 160 bps or 25 per cent in the past 15 months.

The hardest hit will be second- and third-tier NBFCs with lower credit rating and higher cost of funds. This, the analysts said, could lead to a re-rating of the sector on the bourses. The Business Standard (BS) retail NBFC index has doubled in value since January 2015 against 23 per cent rise in the benchmark S&P BSE Sensex during the period (see adjoining chart).

The interest cost for 22 retail NBFCs declined to 8.9 per cent (on average) during 2016-17 from a high of 10.4 per cent during 2012-13. It followed the trajectory of bond yields, albeit with a lag. The yields averaged 8.4 per cent during FY12 and it declined to as low as 6.2 per cent during the last quarter of the 2016 calendar year. Yields are currently hovering around 7.8 per cent.

NBFCs' cost of funds was up 40 basis points (bps) during the first half of FY18 over the last fiscal year and analysts see its rising further as bond yields continue to head north. Yields on government of India 10-year bonds are up nearly 160 bps or 25 per cent in the past 15 months.

The hardest hit will be second- and third-tier NBFCs with lower credit rating and higher cost of funds. This, the analysts said, could lead to a re-rating of the sector on the bourses. The Business Standard (BS) retail NBFC index has doubled in value since January 2015 against 23 per cent rise in the benchmark S&P BSE Sensex during the period (see adjoining chart).

The interest cost for 22 retail NBFCs declined to 8.9 per cent (on average) during 2016-17 from a high of 10.4 per cent during 2012-13. It followed the trajectory of bond yields, albeit with a lag. The yields averaged 8.4 per cent during FY12 and it declined to as low as 6.2 per cent during the last quarter of the 2016 calendar year. Yields are currently hovering around 7.8 per cent.