More complications in filing income tax returns

New ITR form might be simpler but there are minor changes in regulations that might stump you

)

premium

graph

Last Updated : Jul 10 2017 | 3:54 AM IST

Until recently, a person didn’t need to file a return if his taxable income was below Rs 2.5 lakh. But this year onwards, it doesn’t solely depend on the taxable income. Now, if the taxpayer has exempted income like long-term capital gains that crosses the basic exemption limit of Rs 2.5 lakh, he needs to file returns mandatorily.

For example, if an individual redeems equity mutual funds (MFs) worth Rs 3 lakh held for over a year and has no other income. The gains from the investment are tax-free. The entire income, therefore, is exempted from tax. But even in such cases, the taxpayer needs to file return mandatorily. “Taxpayers may not be aware of such minor changes in the regulation but these can lead the authorities to issue a notice,” says Kuldip Kumar, partner and leader - personal tax, PwC India.

The government latest norms to capture details of your income and assets have made things more tedious. And, a small error or omission of information can prove costly in the future.

Linking Aadhaar and PAN is compulsory: On Tuesday (July 4), the Central Board of Direct Taxation issued a notification stating all those who file income tax return need to quote their Aadhaar details or enrolment number compulsorily.

Tax experts say that in June, when the Supreme Court had granted partial relief to those who don’t have an Aadhaar, many thought it’s possible to file returns even if they don’t have an Aadhaar. The apex court had only asked the government not to cancel PAN of those who don’t have an Aadhaar. It was meant only for those who don’t have to file the return. Such individuals can quote their PAN for financial transactions. “Taxpayers without the Aadhaar number or the enrolment ID will not be able to file their tax returns from July onwards,” Archit Gupta, founder and CEO, Cleartax.

Many also feared their PAN would become invalid if not linked to Aadhaar by the end of June. But, that’s not the case. You can still link them by going to the income tax e-filing portal.

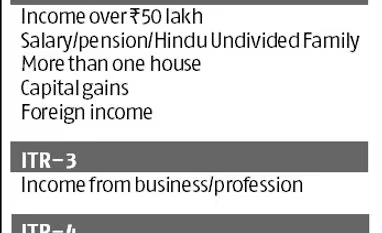

Change in ITR forms: To make it easier for individuals to file returns, the government has rationalised ITR forms. The number of forms has been brought down to seven, from the earlier nine this assessment year. “Few ITR forms are merged for simplicity. The ITR-2 form this year replaces three ITR-2, ITR-2A and ITR-3 issued last year,” says Suresh Surana, founder, RSM Astute Consulting Group.

The ITR-1 (Sahaj) this year is just a one-page form that can be used by individuals earning up to Rs 50 lakh a year and has only salary income, interest income and income from house property. Those who earn over Rs 50 lakh or own more than one house property, they need to opt for ITR-2 Form.

Additional disclosure for high-income earners: Last assessment year, the government introduced a Schedule AL in the ITR for those who earn Rs 50 lakh or more. These high-income earners had to disclose specified assets and liabilities held at the end of the financial year.

Until last year, the taxpayers were only required to disclose assets such as immovable properties, cash in hand, jewellery, vehicles, and so on. This year, the tax authorities have widened the requirements in the scheduled. These taxpayers now need to also disclose financial assets such as stocks, MF, insurance, etc,. They also need to disclose the address of immovable properties and the description of movable assets. “If an assessee has an interest in a partnership firm, then he needs to provide the PAN of the partnership firm and details of investment in it,” says Gupta.

Disclose all incomes: Majority of the individuals are not aware that the interest earned on the money kept in savings bank account attracts tax if it crosses Rs 10,000. But, even if it is below that threshold, it needs to be reported when filing the return. There’s also a misconception that the interest earned on five-year tax-saving fixed deposit (FD) does not attract tax. While the FD helps to save tax during at the investment stage under Section 80C, the interest earned is fully taxable.

Also, while your bank FD is subjected to tax deduction at source (TDS), you still need to pay tax on the interest depending on your income tax slab. Banks deduct only 10 per cent as TDS. If you fall in 20 per cent or 30 per cent tax bracket, you will need to pay the additional tax on the returns accrued on FDs.

Cash deposits during demonetisation: During demonetisation, if you had cash deposits of over Rs 2 lakh, you need to report it when filing the return. “You need to provide details of the money deposited and details of bank account such as name, IFSC code and account number. This is a common requirement across all ITR forms,” says Surana. The authorities already have data from the banks. They would cross-check the details with the data from banks. In case of discrepancies, they can initiate action. Ensure you report this correctly.

Change in timelines: You can now revise your return even if you don’t file it by the July 31 deadline. Earlier, a taxpayer could revise return only if he had filed it by the deadline. Say, an individual files tax return in August, past the deadline. He is free to revise returns in case of errors until March 31, 2019.

At the same time, the government has also reduced the time granted to file belated returns from the next assessment year. As of today, the taxpayer can file returns for the financial year 2016-17 until March 31, 2019. Going forward, an individual has to file the return within one assessment year. The returns for 2017-18 has to be filed by March 31, 2019.