JSW buys Jaypee's hydro plants for Rs 9,700 cr

With a total hydro asset base of 1,300 Mw, JSW is now the largest private producer of hydro power in the country

)

JSW Energy, controlled by billionaire Sajjan Jindal, has acquired two of Jaiprakash Power Ventures’ hydro power plants, with a combined capacity of 1,391 Mw, for Rs 9,700 crore.

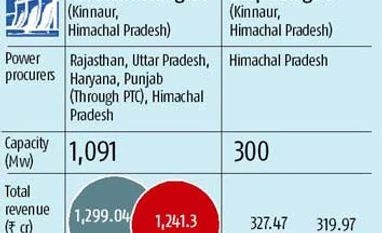

The board of directors of Jaiprakash Power Ventures, a fully owned subsidiary of the Jaypee group, has approved the 100 per cent transfer of businesses of its operating power plants — the 300-Mw Baspa-II hydroelectric plant (commissioned in 2003) and the 1,091-Mw Karcham Wangtoo plant (commissioned in 2011), in Himachal Pradesh.

The price paid by JSW Energy, however, was higher than what analysts has estimated. “We expected Rs 9,000 crore for these assets. So, in our view, JSW Energy has overpaid about Rs 700 crore,” said Bhargav Buddhadev, an analyst with domestic brokerage Ambit Capital.

Jaypee’s entire hydropower portfolio of three plants was up for sale. Of these, JSW has bought two with an asset value of 50 years. Since the acquired capacity is operational, this deal would add to JSW’s generation capacity, revenue, PAT (profit after tax) and Ebitda (earnings before interest, tax, depreciation and amortisation). With a total hydro asset base of 1,300 Mw, JSW is now the largest private producer of hydro power in the country.

Earlier, Anil Ambani-promoted Reliance CleanGen had decided to buy Jaypee’s entire hydro portfolio but that deal had run into regulatory troubles. Before that, Abu Dhabi’s Taqa had pulled out of a deal to buy the assets for Rs 9,689 crore.

The Jaypee group, the largest private player earlier, has been selling assets to lower its debt burden. The standalone debt of the group’s flagship Jaiprakash Associates stood at Rs 28,164 crore as on March 31. Its interest cost in 2013-14 had almost doubled to Rs 6,094 crore from Rs 3,134 crore a year earlier.

“Jaypee Group continues to be on course to bring down its debt and consolidate its operations in the given economic scenario... With this transaction, we have demonstrated that precious assets of credible promoters always evoke interest, even when the economy is facing headwind,” said Group Chairman Manoj Gaur.

After the acquisition, JSW Energy’s aggregate installed and operational power-generation capacity has reached 4,531 Mw. “Considering the projects’ operational track record, with fairly stable hydrology, the acquisition will yield immediate cash flow. It is expected to enhance JSW Energy’s consolidated profitability & returns and create significant synergies,” the company said in a statement.

The acquisition also marks consolidation in the sector, which has been marred by over-leveraged balance sheets.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Nov 17 2014 | 12:58 AM IST