Spectrum auction ends, govt to get Rs 1.09 lakh crore

This is a 33 per cent increase over the reserve price

)

The total earning is more than what the Department of Telecommunications (DoT) had estimated initially. It had estimated to garner between Rs 80,000 crore and Rs 1 lakh crore from the biggest spectrum auction so far. The government had put a total of 470.75 MHz of spectrum for auction in the 800-MHz, 900-MHz and 1800-MHz bands, and 2100-MHz band across 17 circles.

The DoT did not disclose details of the final results of the auction as the Supreme Court has barred the it to do so without its permission. A hearing in the apex court in this regard is scheduled for March 26.

Major telecom operators including Bharti Airtel, Vodafone India, Idea Cellular and Reliance Communications have been bidding fiercely to regain their existing spectrum holding as 29 licences of different operators are coming up for renewal in 2015-16.

The licences of Idea Cellular (nine circles), Bharti Airtel (six circles) and Vodafone and Reliance Telecom (seven circles each) are due for renewal in 2015-16. Overall, 29 licences in 18 service areas are due for renewal in 2015-16. These licences hold 184 MHz of spectrum in the 900 MHz band and 34.2 MHz in the 1800 MHz band. Bihar, Himachal Pradesh, Uttar Pradesh west, Gujarat, Odisha and Kerala circles have seen prices go up by over 100 per cent. Reliance Jio, Tata Teleservices, Telewings (Uninor) and Aircel have also participated in the auction.

Prices in these circles in 900 MHz band have jumped significantly. In Uttar Pradesh (west), the price shot up by 330 per cent, followed by 200 per cent in Bihar, 115.7 per cent in Odisha, 112.1 per cent in Kerala, and 73 per cent in Gujarat.

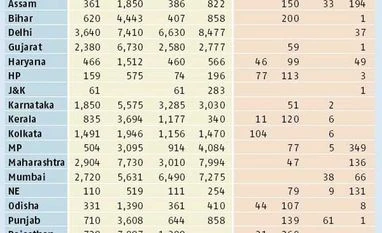

According to provisional data released by the DoT, 418.05 MHz of spectrum was sold. Most money will come from 900 MHz band, where prices shot up from the reserve price in all 17 circles. According to DoT data, Rs 72,964.54 crore will come from the 900 MHz band, almost double of the total reserve price of the spectrum that got sold. Prices almost doubled in 800 MHz band. The government will get Rs 17,158.79 crore from 800 MHz band, where prices have increased in 14 of the 18 circles. It will get Rs 10,115.41 crore from 2100 MHz band where prices increased from the base price in 10 circles of the 14 circles. The remaining Rs 9,636.17 crore will come from 18800 MHz band, where prices increased in nine of the 14 circles.

In deferred payment option, winning bidders will have to pay an upfront payment of 33 per cent in case of 2100 MHz, 1800 MHz bands and 25 per cent for 900 MHz and 800 MHz bands within 10 calendar days of the close of auction. The remaining money will be paid over a period of 12 years – two years’ moratorium and then 10 yearly instalments.

According to the Cellular Operators Association of India (COAI), which lobbies for telecom operators, telecom operators had to bid aggressively to regain existing holding which fuelled the price. “The outcome of this auction, in whichever manner, will eventually lead to a significant outflow of funds and further burden the industry, which already remains under a debt of Rs 2.5 lakh crore,” said Rajan S Mathews, director-general, COAI.

A Vodafone spokesperson said: “We participated in the recent spectrum auction to ensure continuity of business and service to our customers. We remain committed to providing seamless connectivity and superior communication services to our customers across the country. We will make a further announcement once the DoT announces the results of the auction.”

The increased financial burden, Mathews said, would lead to the telecom sector’s cost structure being changed drastically. “The operators will not be left with much choice, but to increase the tariffs so as to meet the financial commitments to the government. We are awaiting official details of the results with the list of the winners, to understand and figure out the way ahead hereon,” he added.

Echoing similar sentiments, Hemant Joshi, partner, Deloitte Haskins & Sells, said: “Debt burden for industry would definitely increase by 70-80 per cent of the spectrum price paid. Balance sheets would get further leveraged and profitability and cash flow would be adversely impacted in servicing of principle and interest and amortisation of spectrum cost.

This will essentially lead to increase in tariffs, impacting the consumers. “The government has won but whether India and industry will win is contingent on how the money collected is used for building telecom infrastructure,” said Joshi.

Arpita P Agarwal, leader (telecom) at PwC, said spectrum auction outgo would impact the rollout and quality of telecom network. “In this competitive environment, operators will find it difficult to raise data or voice tariffs in the immediate term. With the auction completion, the government should bring back focus and provide roadmap on pending issues of spectrum trading, sharing and merger and acquisitions guidelines,” she added.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Mar 26 2015 | 12:49 AM IST