A leader at reasonable price: HDFC AMC IPO to hit market on Wednesday

Retail focus, high share of more profitable equity funds and low penetration levels will support growth in the long run

)

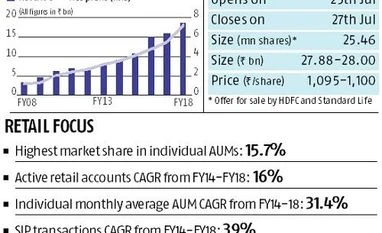

HDFC Asset Management Company (HDFC AMC), India’s second-largest by assets under management (AUM), will hit the market on Wednesday, making it the fifth listed entity from HDFC group. With all group companies — HDFC, HDFC Bank, Gruh Finance and HDFC Standard Life Insurance — having delivered a good performance as well as stock returns to investors over time, experts believe that HDFC AMC will also be an interesting case going ahead. “HDFC AMC would report better growth performance in the long run and will match up to its listed group companies,” says Sunil Jain, head of research at Nirmal Bang. There are many reasons suggesting that despite being in business for almost two decades and having attained its current size, the future looks bright, and investors should subscribe to the offer.

Strong show, retail advantage

HDFC AMC has delivered strong performance in the past with its revenues and net profit growing at a compounded annual rate (CAGR) of 19-20 per cent over 10 years (FY08-18), which has helped it become the industry leader in terms of net profit. A 10-year period is a decent time-frame given that it captures a few market cycles. This growth has been aided by an increase in its AUM, which clocked 25.5 per cent CAGR over the last five years to Rs 2.9 trillion. The AUMs are important for AMCs as they earn fee income (revenue), which is a proportion of the funds they manage.

Mutual fund business, however is exposed to the financial market volatility and the risk tends to be higher in the short term as fund inflows from investors get impacted if returns are weak or lower than in other asset classes or if the perceived risk increases. Fund returns too get impacted in the short run. But, Jain of Nirmal Bang explains, “Of late, in last one year, the performance of HDFC AMC’s funds was not on a par with its past performance. However, the long-term performance is a better way to judge, and HDFC AMC has done well.” Yet, for HDFC AMC to stand in line with its listed group companies, the company needs to deliver structural growth, says Dhananjay Sinha, Head of Research, Economist & Strategist, Emkay Global Financial Services.

Also Read

A key advantage for HDFC AMC is that its focus is on the retail side that generally invests in mutual funds for a longer term, where risk to fund flows is comparatively low. About 62 per cent of its AUM is accounted for by retail investors. Besides AUM, other data-facts, too, highlight its retail edge (see box).

“We are long-term players, and people are also investing with at least 3-5 years’ view through SIP (systematic investment plan) or other channels. So volatility, which is more in the short-term, does not bother much to long-term investors,” Milind Barve, MD, HDFC AMC told Business Standard. Fund flow through SIP route is also growing fast, giving long-term asset visibility—about 77 per cent of SIP flow for HDFC AMC has over five year-commitment. Another aspect where the company stands out is the high margin-equity funds, where it has outpaced the industry with a higher share of equity funds. Since equity fund AUMs earn higher fee income than debt funds, they also boost HDFC AMC’s profits.

Individual investors’ proportion in HDFC AMC’s AUM pie would also be boosted with strong and established customer base of HDFC Bank (43 million with 4,787 banking outlets across India as of March 2018), which accounted for just 10 per cent of the former’s AUM, indicating large room for customer acquisition. Nevertheless, HDFC AMC’s reach is well-diversified and includes digital platform, other banks, individual agents, distributors, etc.

Growing industry, strong team

Lower penetration of mutual funds and a rise in the shift of household savings to financial assets augur well for the industry. Moreover, retail participation would also improve with increasing awareness and rising incomes. “Even currently, the share of retail mutual fund investors in the total investment universe is very small. This provides a good growth opportunity,” Barve adds. An experienced management team with low employee attrition/ churn provides comfort and ensures effective asset management, which is the heart of a mutual fund business.

Valuation

Though some industry experts believe valuation of HDFC AMC (32 times the earnings in FY18) is higher than the only listed peer, Reliance Nippon Asset Management (26 times), many others believe that attributes such as the highest share of equity schemes, high profitability, strong management, steady performance and HDFC’s premium brand justify the valuation. The key risk would be a sustained decline or weak performance of equity markets, which would then reflect on the industry’s growth. HDFC AMC’s profit growth slowed during FY9 and FY12, when equity market performance was weak.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Jul 22 2018 | 9:36 PM IST