A practical Budget, but revenue projections seem optimistic

Widening the tax base and curtailing non-plan expenditure would have added more credibility to the fiscal deficit forecasts

)

Reading the fine print of the Union Budget of FY14, I feel that the FM has done a balancing act between standing by his commitments on keeping the fiscal deficit in check and preparing an inclusive budget in an election year. Some of the positive takeaways are: steps to increase financial savings through inflation-indexed bonds that will provide an alternative to gold investments as an inflation hedge and help improve the trade deficit; incentivising investment in new plant

and machinery through investment allowance deduction; steps in the infrastructure sector like the announcement of a Regulatory Authority for the road sector, new ports and industrial corridors and a commitment to announce policies to encourage hydrocarbon exploration and production of shale gas.

While the proposals don’t talk about big ticket reforms, they show the intent to stay on the growth path and ensure stability of the tax structure.

The 12th Five-Year Plan calls for infrastructure investments to the tune of $1 trillion with 47% private participation. Given that government and private sector companies are under some financial stress, it is imperative to attract foreign investments to fund India’s infrastructure expansion needs. The commitment to improve infrastructure in the food supply chain will help the agriculture sector.

Also, though the FM has stuck to his fiscal deficit target of 4.8 per cent for FY14, the revenue projections seem optimistic. Broadbasing tax coverage and curtailing non-plan expenditure would have added more credibility to the fiscal deficit forecasts.

While the Finance Bill is a major stimulus for the economy, the FM seems to have retained options to exercise further measures through the passage of some of the key bills pending passage through Parliament.

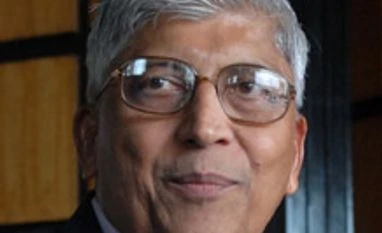

The author is Managing Director and CEO of Larsen & Toubro

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Feb 28 2013 | 7:46 PM IST