Bharti Infratel: Data rollout drives incremental growth

Tenancy ratios expected to improve, to boost profitability

)

Higher data usage, which helps telecom companies boost revenue growth, also helps service providers such as Bharti Infratel that rent towers and related infrastructure to telcos. Aided by a 2.4 per cent improvement in tenancies and tower additions, Bharti Infratel’s September quarter core rental revenues grew two per cent to Rs 1,758 crore compared to the June 2014 quarter. Overall revenues were up three per cent to Rs 2,930 crore with reimbursements registering a five per cent growth sequentially. This is in line with consensus estimates of Rs 2,922 crore.

Bharti Infratel added 3,950 more tenancies in the quarter on a sequential basis, which according to the firm, was on account of a rollout of data networks. Total tenancies stood at 174,270 at the end of the September quarter. The firm expects tenancies to increase after the spectrum auction in February 2015.

Higher tenancies have helped the company improve its average tenancy ratio from 2.02 times in the June quarter to 2.05 times in the September quarter. Bharti Infratel has said there are early signs of tenancies increasing on account of regulatory clarity and pricing power coming back to the operators as well as higher data growth. Given the closing tenancy ratio was pegged at 2.07, the number — a key profitability parameter - is expected to move up. An increase in tenancy ratio translates into higher profitability given lower incremental capital cost.

While Ebitda (earnings before interest, taxes, depreciation and amortisation) increased three per cent to Rs 1,220 crore, Ebitda margins stayed flattish at 41.6 per cent compared to 41.7 per cent in the June quarter, which according to the company is because of seasonality and timing of customer tenancy rather than operational reasons.

Net profit for the period came in at Rs 465 crore flattish compared to the June quarter number of Rs 462.8 crore. The net profit was marginally lower than consensus estimates of Rs 477 crore.

On the Street’s concern of optimal utilisation of cash, the company said it was looking at options such as buybacks, special dividend or inorganic growth avenues in the South Asia region.

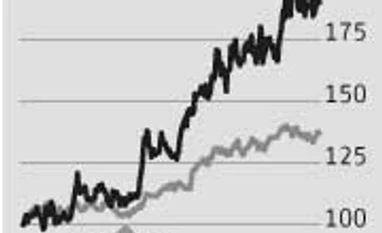

As many as 65 per cent analysts tracking the stock have a ‘buy’ rating on the scrip with a target price of Rs 290. Given that the stock is trading at the same levels, investors might want to wait for a correction to make investments. The stock has had a good run over the past year, enriching investors with a return of over 90 per cent.

Bharti Infratel added 3,950 more tenancies in the quarter on a sequential basis, which according to the firm, was on account of a rollout of data networks. Total tenancies stood at 174,270 at the end of the September quarter. The firm expects tenancies to increase after the spectrum auction in February 2015.

While Ebitda (earnings before interest, taxes, depreciation and amortisation) increased three per cent to Rs 1,220 crore, Ebitda margins stayed flattish at 41.6 per cent compared to 41.7 per cent in the June quarter, which according to the company is because of seasonality and timing of customer tenancy rather than operational reasons.

Net profit for the period came in at Rs 465 crore flattish compared to the June quarter number of Rs 462.8 crore. The net profit was marginally lower than consensus estimates of Rs 477 crore.

On the Street’s concern of optimal utilisation of cash, the company said it was looking at options such as buybacks, special dividend or inorganic growth avenues in the South Asia region.

As many as 65 per cent analysts tracking the stock have a ‘buy’ rating on the scrip with a target price of Rs 290. Given that the stock is trading at the same levels, investors might want to wait for a correction to make investments. The stock has had a good run over the past year, enriching investors with a return of over 90 per cent.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Oct 27 2014 | 9:35 PM IST