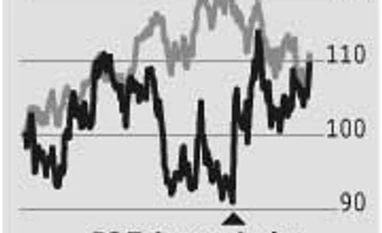

Data tariffs likely to fall 25% post Jio launch

Street turns cautious as competitive intensity may cap returns on capital invested in expensive spectrum

)

Analysts believe listed telecom players such as Bharti and Idea would focus on monetising their investments in the sector by pushing for higher data consumption. Cumulatively, Bharti Airtel is estimated to have invested Rs 47,700 crore in spectrum, while Idea invested Rs 41,000 crore in the past two auctions. ICICI Securities believes while consequent expansion in return on invested capital should start reflecting from FY17, the launch of long-term evolution services by RJio, likely in the second half of FY16, could keep the near-term prospects challenging for the incumbents.

While data offers immense opportunity, the Street doubts telcos’ ability to monetise this because prices of data are expected to collapse after RJio is launched. Also, competition in India is expected to be far more intense. In each circle, there are seven to eight telecom players, which would keep a check on pricing, even as spectrum costs have gone up. Jeffries says, “The entry of a new significant player, RJio, would worsen the situation, especially on the data side, which is expected to drive sector growth. Bharti and Vodafone are at risk, while Idea’s growth prospects could be affected due to lower data presence.”

Analysts believe Idea has gained from reduced competition after the cancellation of 2G licences. However, with rising costs and inability to pass them on to consumers would impact Idea's return on invested capital. Bharti, analysts believe, could be the bigger loser as data cannibalises voice revenues. As a result, many analysts are positive on telecom infrastructure players than the operators. Emkay Global expects data price correction to happen in India like in Indonesia, where data price has corrected by 25 per cent after a data-only provider launched services. Increase in data consumption has impacted voice realisations of telecom companies in other large markets such as China. IIFL, however, is less bearish and believes there could be a four per cent industry revenue impact in two years. But the brokerage expects this to happen only when smartphone/VoIP adoption reaches a critical mass in the predominantly pre-paid and price-sensitive segment where it is difficult to implement defensive measures.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Jun 19 2015 | 9:36 PM IST