FinMin to meet bank officials on March 21 on loan recovery

It'll also deliberate on ways how banks can be more proactive in dealing with cases of wilful and genuine defaulters

)

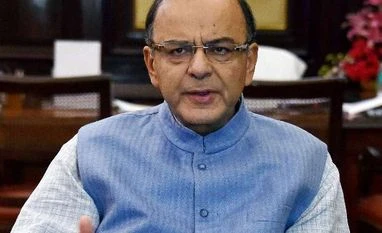

Union Minister for Finance Arun Jaitley interacts with the media on the volatility of the share market in New Delhi. Photo: PTI

The finance ministry has convened a meeting of senior bankers of PSBs dealing with large loan defaults next week as part of an exercise to clean up balance sheet of banks. The meet, slated for March 21, will discuss bad loan issues and recovery, sources said.

It'll also deliberate on ways how banks can be more proactive in dealing with cases of wilful and genuine defaulters, the sources added. Gross NPA of PSBs rose to Rs 3.61 lakh crore, while that of private lenders was at Rs 39,859 crore at the end of December 2015.

Gross NPA ratio as percentage of advances rose to 7.30 per cent while for private banks, it stood at 2.36 per cent as of December-end.

Also Read

There are some 7,686 wilful defaulters who owe Rs 66,190 crore to PSBs, 6,816 suits have been filed and FIR has been lodged in 1,669 cases.

Banks have initiated action under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act (Sarfaesi) Act in 584 such cases.

Amid outrage over embattled Vijay Mallya's alleged massive loan default, Finance Minister Arun Jaitley and RBI Governor Raghuram Rajan had cautioned against going on a "fishing expedition" on bad loans so that it doesn't make banks worried about lending in future.

However, Jaitley made it clear that individual misdemeanors will be "looked into differently".

Echoing his point, Rajan said "we have to be careful as we go forward" and criminal actions are penalised.

"But at the same time, we don't indulge in a broad fishing expedition which then becomes a reason for banks to get worried about making loans which then hamper the recovery as well as the absolutely important investment in infrastructure that have to take place.

"So, as a country, as a system, we have to draw that balance very carefully and we are hopeful that we can manage that," the governor had said.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Mar 17 2016 | 12:37 AM IST