Speaking to CNBC TV18, Kamath said, "There was pressure on industries even before the coronavirus pandemic hit and the GDP contraction of nearly 25 per cent was not a surprise. The last two quarters have been most impacted by Covid-19."

Speaking about the loan restructuring, the chairman said that there will be complications, but "sure that bankers will take a considered decision to reach an equitable proposal." He further added, "I am not second-guessing what clients and banks will do. Banks will have to recast loans in such a way that payments happen."

The interview came a day after the findings of the committee were accepted by the RBI, which on Monday issued a circular detailing the financial parameters to be followed by lending institutions. According to the much-awaited report, the pandemic affected retail and wholesale trade, roads, textiles, and engineering the hardest, while sectors that were already under stress, such as non-banking financial companies (NBFC), power, steel, and real estate, piled up more misery due to the crisis.

The committee identified almost all major sectors including auto, real estate, and aviation. It also found areas such as agriculture, food, pharma, and IT, among a few others, that remained mostly unaffected.

"We took the industry's views to frame rules which are pragmatic and took the collective view of borrowers lenders in the exercise," Kamath added stating that there will be a lot of codependence of borrowers on other sectors.

Speaking about the employment situation which has been hit by the Covid-19 lockdown and the wave of migration, Kamath said, " Jobs in the unorganised sectors are coming back which is good news. Once the economy comes back and the pain goes down over the next three quarters, other jobs will come back as well."

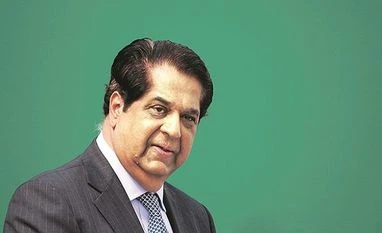

The former chief of New Development Bank K V Kamath in his report did not specify the amount that would need restructuring but gave its recommendations basing itself on parameters after discussion with stakeholders and rating agencies, and going through financial reports of companies as well as some of those of the RBI.

)