RBI tightens screws on banks to ease bad debt

New rules push mergers if capital levels fall below set ratios

)

graph

The Reserve Bank of India’s (RBI’s) new — revised after 15 years — prompt corrective action (PCA) plan on loans going bad at banks could restrict normal business activity for at least 15 of the stressed lenders.

And, once such a PCA plan is put in place, a bank will have to do what the RBI wishes the lender to do, putting the central bank in the driver’s seat in bad debt resolutions.

Any bank with a net non-performing assets (NPA) ratio of six per cent or more, as of March 2017, will come under the scanner of the RBI. The central bank can then direct the bank on how to go about its business.

System-wide, stressed assets (gross bad debts plus restructured assets) were estimated to be at least Rs 9.5 lakh crore.

Since all existing bad debt resolution plans have largely failed, the government is devising its own grand resolution plan.

Also Read

In the 2002 plan, the threshold was set at 10 per cent. Under the new norm, 17 banks have come under the RBI lens.

As of December 2016, they had a net NPA ratio of more than six per cent.

Of these, only three banks have a net NPA ratio of more than 10 per cent, which meant they were already under the RBI lens.

These three are Indian Overseas Bank (NNPA of 14.3 per cent), Bank of Maharashtra (10.7 per cent) and United Bank of India (10.6 per cent). Of these, a PCA plan has been triggered on Indian Overseas Bank and United Bank.

The new norm will be applicable based on the results as of March 31. Even as a couple of banks marginally escape the strict RBI watch, a sizable chunk will surely get in the net.

Apart from the NPAs, a PCA plan may be triggered if a bank slips on any of three other parameters – on capital, profitability or even how much leverage it has taken on its books. If, for example, a bank’s capital adequacy falls below a critical level or if a bank posts losses year after year, RBI can impose a PCA plan on it.

When a PCA plan is activated, RBI would impose severe restrictions on many and any of the criteria the central bank deems fit. A particularly harsh one is to limit the bank's lending ability of the bank. In extreme cases, to restrict the compensation and fees of the management and directors.

And, if a bank continues to bleed on its capital and the core capital ratio falls below a specified level, it could be liquidated or merged. In the 2002 plan, the threshold for winding up a bank was set at three per cent of the capital adequacy ratio. In the revised plan, the threshold is 3.625 per cent of core capital or the tier-1 ratio. A bank's capital has two layers, tier-1 and tier-2. A 3.625 per cent tier-1 means the total capital adequacy ratio would be higher, definitely much more than what was prescribed in the 2002 plan.

What has changed

NOTE: * The capital criteria will change as Basel-III is implemented in stages.

** For consecutive years

As in the previous plan, there will be three threshold levels. For breaching each level, a specified level of restriction will fall upon the bank. For example, if the first threshold is breached, the central bank will impose restrictions on dividend distribution, and ask the promoters (or parent of a foreign bank) to infuse capital. If the third threshold is breached, the bank can be wound down or forcefully merged with others.

Unlike the earlier PCA, this time the framework will be revised every three years.

When threshold two is breached, RBI can put restrictions of threshold one-plus. Meaning action such as restricting the branch expansion and to direct higher provisioning as part of the coverage regime. In threshold three, RBI mandatorily will impose restrictions on management compensation and directors’ fees.

In fact, going by the rules, there is no restriction RBI cannot impose. The central bank may, at its discretion, impose restrictions and penalties such as special supervisory interactions, actions on strategy, governance, capital, credit risk, market risk, human resource, profitability and on operations. It may review all business lines to identify scope for enhancement or contraction (restriction on lending and borrowing), restructuring of operations, devise plans for NPA reduction, or any other restrictive step that will halt the normal operation till such parameters are improved.

According to an analyst with a rating agency, the new focus is on early detection of stress signs and taking action in time to avoid further spread.

Triggers

- Banks will be monitored based on such measurable indicators as capital adequacy ratio, common equity tier-1 ratio (core capital), net NPA ratio and return on assets;

- For Threshold-1, capital trigger will set when a bank’s minimum total regulatory capital falls 250 basis points (bps) below the indicator or the minimum tier-1 capital adequacy ratio (CAR) falls 162.50 basis points below indicator. Currently, RBI’s minimum threshold for total capital is 10.25 per cent;

- Threshold-2 triggered when total CRAR (capital to risk-weighted assets ratio) falls more than 250 bps but less than 400 bps below indicator. Or tier-1 capital falls more than 162.5 bps, up to 312.5 bps;

- In excess of 312.5 bps fall in tier-1 capital below the regulatory minimum, candidate for amalgamation, reconstruction or winding up;

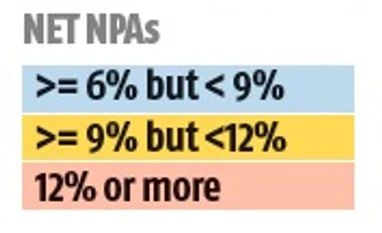

- In terms of asset quality, threshold-1 will trigger when the net NPA ratio is equal or greater than six per cent but less than nine per cent. For threshold-2, from nine to 12 per cent. Threshold-3 will be triggered when net NPA ratio is 12 per cent or more;

- In terms of profitability, threshold levels will be negative return on assets for two consecutive years, three and then four consecutive years;

- Leverage of 25 times of the tier-1 capital will come under the threshold level

- PCA framework applies to all banks, including small and foreign ones;

- A bank will be placed under the PCA framework based on the audited annual financial results and supervisory assessment by RBI. However, RBI may also impose a PCA on any bank if circumstances so warrant, it has said on its website.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Apr 14 2017 | 2:01 AM IST