Duty raise to see gold imports dip 20%

Levy in India one of the highest in the world; finance minister urges banks to tell customers not to invest in the metal

)

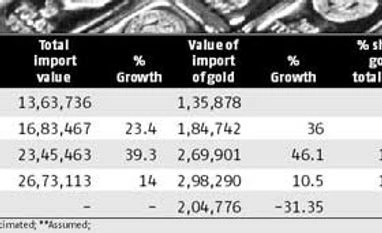

Gold imports in 2013-14 are expected to fall by 20 per cent following a steep hike in import duty to eight per cent and measures taken by the Reserve Bank of India (RBI) to restrict imports. The import duty in India is one of the highest in the world.

With the duty gone up by two percentage points, customs duty collections on gold imports will be higher by 60 per cent, or $2.9 billion (Rs.16,382 crore) this financial year against Rs 10,300 crore in 2012-13.

"The government took an unwarranted step of increasing duty as it adds the cost of jewellery. With hike in duty and other measures, import this year is expected to come down by 20 per cent," said Haresh Soni, chairman of the All India Gems and Jewellery Trade Federation (GJF).

He has suggested measures to curb investment in gold by asking banks, post office, etc to discourage the sale of coins and bars. Apart from individuals, corporates are also big investors in gold in the form of exchange traded fund (ETF), he added.

China, another major gold importer, has no import duty on gold. Taiwan also does not attract any duty, but South Korea has three per cent duty.

With eight per cent duty on imports and a cess, it comes to 8.24 per cent and one per cent value-added tax will be added. Besides, one per cent TCS (tax collection) at source is applicable on cash sale.

"This will incentivise a rise in gold import from illegal channels in the country," said Prithviraj Kothari, managing director, Riddisiddhi Bullions. He said one kilogram of smuggled gold into India, where the bar has a size similar to an I-Phone, would yield $4,160 (Rs. 2.4 lakh). To bring gold into the country, organised illegal channels could finance porters and collect the metal at their return to the country.

The hub for bringing gold into India is Dubai, but gold can enter the country from other directions as well. "Illegal gold may enter through borders adjoining Bangladesh, Nepal, Pakistan and Shri Lanka," said Bachhraj Bamalva, director, GJF.

India imported 1,021 tonnes of gold in 2012-13 through official channels. However, GFMS Thomson Reuters has estimated 102 tonnes of gold entered the country through unofficial route last year. In the current year, smuggling is expected to be much higher.

More steps in the offing

"With high duty and other import restrictions, banks would deal differently with investors and firms specialised in bullion investment. Gold demand for jewellery has never fallen due to high taxes but investment demand is likely to be hit in the coming months," said Suvanker Sen, executive director at Kolkata-based Senco Gold.

Meanwhile, Finance minister P Chidambaram today said the surging imports were unsustainable and advised the banks to tell customers not to invest in the precious metal. Rajiv Takru, financial services secretary, also said the government might take more steps if needed to curb gold inflows into the country.

Prices up 1.7 per cent after duty

After last night's announcement of further increase in import duty, gold prices in Mumbai's Zaveri Bazar today increased 1.72 per cent to Rs 27, 570 per 10 gram. A lower rupee also contributed to the increase in prices today. The rupee closed 12 paise lower at Rs 56.85 against the dollar.

With the duty gone up by two percentage points, customs duty collections on gold imports will be higher by 60 per cent, or $2.9 billion (Rs.16,382 crore) this financial year against Rs 10,300 crore in 2012-13.

"The government took an unwarranted step of increasing duty as it adds the cost of jewellery. With hike in duty and other measures, import this year is expected to come down by 20 per cent," said Haresh Soni, chairman of the All India Gems and Jewellery Trade Federation (GJF).

He has suggested measures to curb investment in gold by asking banks, post office, etc to discourage the sale of coins and bars. Apart from individuals, corporates are also big investors in gold in the form of exchange traded fund (ETF), he added.

China, another major gold importer, has no import duty on gold. Taiwan also does not attract any duty, but South Korea has three per cent duty.

With eight per cent duty on imports and a cess, it comes to 8.24 per cent and one per cent value-added tax will be added. Besides, one per cent TCS (tax collection) at source is applicable on cash sale.

"This will incentivise a rise in gold import from illegal channels in the country," said Prithviraj Kothari, managing director, Riddisiddhi Bullions. He said one kilogram of smuggled gold into India, where the bar has a size similar to an I-Phone, would yield $4,160 (Rs. 2.4 lakh). To bring gold into the country, organised illegal channels could finance porters and collect the metal at their return to the country.

The hub for bringing gold into India is Dubai, but gold can enter the country from other directions as well. "Illegal gold may enter through borders adjoining Bangladesh, Nepal, Pakistan and Shri Lanka," said Bachhraj Bamalva, director, GJF.

India imported 1,021 tonnes of gold in 2012-13 through official channels. However, GFMS Thomson Reuters has estimated 102 tonnes of gold entered the country through unofficial route last year. In the current year, smuggling is expected to be much higher.

More steps in the offing

"With high duty and other import restrictions, banks would deal differently with investors and firms specialised in bullion investment. Gold demand for jewellery has never fallen due to high taxes but investment demand is likely to be hit in the coming months," said Suvanker Sen, executive director at Kolkata-based Senco Gold.

Meanwhile, Finance minister P Chidambaram today said the surging imports were unsustainable and advised the banks to tell customers not to invest in the precious metal. Rajiv Takru, financial services secretary, also said the government might take more steps if needed to curb gold inflows into the country.

Prices up 1.7 per cent after duty

After last night's announcement of further increase in import duty, gold prices in Mumbai's Zaveri Bazar today increased 1.72 per cent to Rs 27, 570 per 10 gram. A lower rupee also contributed to the increase in prices today. The rupee closed 12 paise lower at Rs 56.85 against the dollar.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Jun 06 2013 | 10:35 PM IST