Fed patience helps bull stage comeback

Sensex surges 416.44 points; Nifty rises 129.50 points

)

The “patience” promised by the US Federal Reserve in terms of a decision on when to raise interest rates helped bulls stage a comeback on Thursday.

Comfort from the Fed’s statement revived global risk appetite, which had taken a beating through the past week. The positive sentiment helped domestic equities, bonds and the rupee reverse some of the recent losses. The benchmark Sensex ended at 27,126.57, up 416.44 points, or 1.6 per cent, the most since October 31. The broader Nifty rose 129.5 points, or 1.6 per cent, to close at 8,159.3, with 45 of its components ending without losses.

Market players said gains were accentuated on account of the winding up of short positions, which had mounted through the past few sessions. Most Asian and European markets posted strong gains on the Fed’s statement that it would be patient on interest rates.

Despite strong gains, foreign investors continued to pull out money from the Indian market. On Thursday, they sold shares worth Rs 875 crore, extending their seven-day selling tally to nearly Rs 6,000 crore. “The market may consolidate at this stage, as everyone will now watch for a possible earlier-than-expected rate rise by the Fed. Earlier, most investors were expecting it to happen in the later part of 2015 but from the indications, it might happen early,” said Nirmal Jain, chairman of IIFL.

On Thursday, the rupee ended at 63.11 a dollar, compared to its previous close of 63.25/dollar. The 10-year benchmark government bond rose four basis points to 7.93 per cent.

The Cabinet’s approval for a proposed goods and services tax (GST), a key reform, also boosted sentiment. “GST looks to be moving closer to reality. It is likely to have a very positive impact on the economy, with estimates indicating a potential one-two per cent positive impact on GDP growth,” said Dinesh Thakkar, chairman & managing director, Angel Broking.

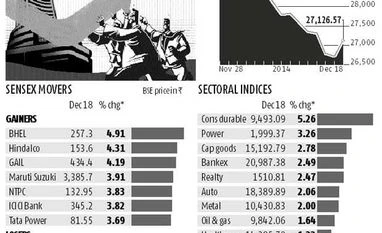

On Thursday, buying was witnessed across the board, with all BSE sectoral indices ending with gains. The consumer durables index (up 5.3 per cent) and the power index (up 3.3 per cent) were the best performers. Among major stocks, Bharat Heavy Electricals, Hindalco and ICICI Bank were the prominent gainers.

A slight recovery in crude oil prices boosted the stocks of Reliance Industries and Oil and Natural Gas Corporation. Analysts say the 40 per cent drop in crude oil prices is likely to impact foreign flows into the Indian market. Market players hope buying by domestic investors provides a cushion against foreign institutional investor (FII) selling. “Key macro factors are showing signs of turning around. Indian households are expected to emerge as big buyers of equities in the coming years, making Indian markets less susceptible to FII flows,” IIFL said in a note.

In the past few trading sessions, local investors have been aggressive buyers, even as their foreign counterparts pressed the ‘sell’ button. On Thursday, domestic investors purchased shares worth Rs 650 crore.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Dec 18 2014 | 10:50 PM IST