Gold moves up on heavy consumer buying

Gold prices jump by 2% in a day driven by improved consumer sentiment ahead of the wedding season

)

Standard gold jumped over 2 per cent in Zaveri Bazaar here on Saturday following a rebound in global markets on Friday. A sharp improvement in consumer sentiment in Asian countries, largely in India and China, led to the reversal in prices.

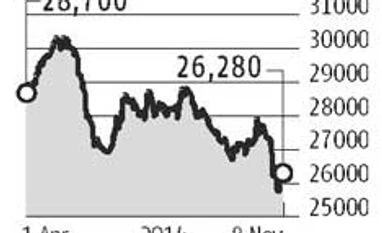

Gold price moved up by Rs 530 to close on Saturday at Rs 26,280 per 10 grams. The rise in gold price halted the falling trend which was seen for the last several months.

“Consumer sentiment was bullish. With the wedding season ensuing, consumers preferred to book all types of ornaments before any price rebound which led to almost all footfalls turning into consumers,” said Kumar Jain, partner, Umedmal Tilokchand Zaveri, a Zaveri Bazaar based bullion dealer and jewellery retailer.

In the international markets, gold price jumped above the psychological level of $1155 an oz on Friday afternoon before retreating after US non-farm payrolls data undershot, which weighed on the dollar. The upward move continued to close gold at $1178.8 on Friday, a significant rise from $1147.9 an oz on Thursday. Gold got support from weak US job data which was reported at 214,000 in October as compared to 248,000 jobs in September and lower than expectations of 235,000.

Meanwhile, the European Central Bank (ECB) in its meeting on Thursday holds its interest rates at the lowest point of 0.05 per cent and deposit rates at minus 0.2 per cent. Further, ECB President Mario Draghi is preparing for central banks action in testing the limits of his power. The EU is struggling to spur economic growth in the region after two years of constant efforts from central bankers to the save the Euro. Additional stimulus measures by the central bank have failed to provide support to economic recovery in the region.

At the latest press conference the President stated central bank will probably insist in overcoming divisions on the Governing Council as official prepare their final forecasts in 2014. In addition to this, policymakers in current meeting did not annouce any major new steps but hinted towards the willingness of expanding asset buying program as soon as from December. The picture of additional measures will be clear once revised predicitions come for the Euro Zone for the current year. The ECB’s decision weighed on the dollar with the greenback traded last at 1.2374 against the euro.

Meanwhile, China has come back to the gold market with its import in October from Hong Kong was reported the highest in five months due to the yellow metal trading at a discount.

Currently, gold is selling at around $22 premium in India due to reduced supply on several holidays in the last two weeks. “With the resumption of working days, gold supply is expected to ease. But, demand will continue to surge on reduced prices thereby, expecting better sales this year. Overall gold price trend is expected to remain weak, though,” a jeweller said.

Spot silver closed on Saturday with a decline of Rs 300 at Rs 35,500 a kg on lower demand. Silver in global markets recorded a $0.6 an oz jump on Friday to $15.698 an oz.

“For the next week we expect gold prices to find support in the range of Rs 25,500–25,400 levels. Trading consistently below Rs 25,400 levels would lead towards the strong support at 25,100 levels and then finally towards the major support at 24,800 levels,” said Anuj Gupta, an analyst with Angel Broking.

Gold price moved up by Rs 530 to close on Saturday at Rs 26,280 per 10 grams. The rise in gold price halted the falling trend which was seen for the last several months.

“Consumer sentiment was bullish. With the wedding season ensuing, consumers preferred to book all types of ornaments before any price rebound which led to almost all footfalls turning into consumers,” said Kumar Jain, partner, Umedmal Tilokchand Zaveri, a Zaveri Bazaar based bullion dealer and jewellery retailer.

In the international markets, gold price jumped above the psychological level of $1155 an oz on Friday afternoon before retreating after US non-farm payrolls data undershot, which weighed on the dollar. The upward move continued to close gold at $1178.8 on Friday, a significant rise from $1147.9 an oz on Thursday. Gold got support from weak US job data which was reported at 214,000 in October as compared to 248,000 jobs in September and lower than expectations of 235,000.

Meanwhile, the European Central Bank (ECB) in its meeting on Thursday holds its interest rates at the lowest point of 0.05 per cent and deposit rates at minus 0.2 per cent. Further, ECB President Mario Draghi is preparing for central banks action in testing the limits of his power. The EU is struggling to spur economic growth in the region after two years of constant efforts from central bankers to the save the Euro. Additional stimulus measures by the central bank have failed to provide support to economic recovery in the region.

Meanwhile, China has come back to the gold market with its import in October from Hong Kong was reported the highest in five months due to the yellow metal trading at a discount.

Currently, gold is selling at around $22 premium in India due to reduced supply on several holidays in the last two weeks. “With the resumption of working days, gold supply is expected to ease. But, demand will continue to surge on reduced prices thereby, expecting better sales this year. Overall gold price trend is expected to remain weak, though,” a jeweller said.

Spot silver closed on Saturday with a decline of Rs 300 at Rs 35,500 a kg on lower demand. Silver in global markets recorded a $0.6 an oz jump on Friday to $15.698 an oz.

“For the next week we expect gold prices to find support in the range of Rs 25,500–25,400 levels. Trading consistently below Rs 25,400 levels would lead towards the strong support at 25,100 levels and then finally towards the major support at 24,800 levels,” said Anuj Gupta, an analyst with Angel Broking.

Silver prices will find support in the range of Rs 33,300 - 33,500 a kg levels. Trading consistently below Rs 33,300 a kg levels would lead towards the strong support at Rs 32,500 a kg levels and then finally towards the major support at 31,500 a kg levels, he added.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Nov 08 2014 | 10:20 PM IST