Indian firms lead AAA league table

73 such listed entities here, against 14 in China, six in Japan and two in America; analysts caution, for reasons, against reading too much into this

)

India, apparently, leads the global league table of AAA-rated companies (for their domestic currency long-term debt) by a huge margin.

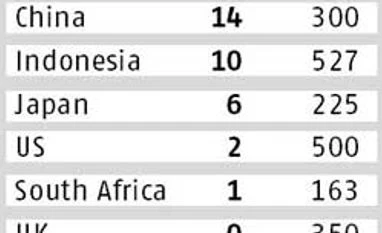

There were 73 such listed companies in India, over five times the corresponding number in China and seven times the number in Indonesia. In South Africa, only one listed entity makes the AAA-cut; Mexico and Russia have none. In the developed world, Japan leads with six companies, followed by America with two; British or German ones do not make the cut.

The analysis is based on the domestic currency long-term debt rating of listed companies belonging to the broad-base indices of respective countries. For example, the Indian universe is the BSE 500. For the US, its S&P 500; for China, the Shanghai 350; for Japan, the Nikkei 225 Index, and so on.

Pawan Agrawal, chief analytical officer of CRISIL Ratings, attributes India topping AAA rankings to the bigger universe of companies in the country and to three factors: Entities owned by the government, multinational companies with a strong parent, and large companies with diversified businesses and robust financial profiles. “We rate more than 14,200 entities and not more than 60 are currently at AAA rating. This is less than 0.5 per cent of the universe. Hence, you cannot call this a large club,” he says.

AAA rating means almost zero probability of default on debt servicing and none of the AAA-rated firms in our universe has defaulted in our 28-year rating history, says Agrawal.

Excluding government owned companies, the Business Standard sample still had 43 AAA-rated ones, still higher than anywhere else in the globe. And, the argument about India’s bigger universe is not entirely true. According to the Bloomberg data, America has around 12,000 listed companies, followed by India at 4,855 (active), China at around 4,000 and Japan at 3,500. China is top in privately owned companies, at around 40 million, against 1.3 mn registered in India.

Rating agencies also say an AAA-rated entity in India is not strictly comparable to a similarly rated one globally, due to the difference in the rating scale. “For Indian companies, a low sovereign rating for India (BBB minus) acts as a ceiling, necessitating the need for a domestic rating scale different from an international scale. This may not be the case in developed markets like Europe, North America, and Japan, where foreign-currency ratings tend to be higher and wide enough for credits to be distinguished,” says Rakesh Valecha, senior director and head of credit and market research at India Ratings.

Technically, a company can’t get a higher credit rating than the corresponding sovereign (government) rating. This puts a ceiling on the ratings of Indian companies and those in other emerging markets that also have lower ratings — Indonesia, South Africa, China, Russia and Mexico, among others. Rating agencies circumvent this by devising a domestic rating scale.

D R Dogra, managing director, CARE Ratings, cautions against reading too much into the bigger universe of AAA-rated companies in India, “Despite a bigger AAA-rated universe here, a typical India company is financially weaker and more indebted than Western peers. It only shows that most industry leaders retain financially strong, despite tough economic conditions for the past few years.”

Experts say there is also a greater incentive to get a AAA-rating company in India. “Internationally, the corporate bond markets are extremely deep and are available for ratings across the entire spectrum. In India, investors are risk-averse and prefer only highly-rated entities. Top Indian corporates, therefore, strive for AAA ratings, which help them access a wide range of investors,” says Agrawal of CRISIL.

This could explain why HDFC, Dewan Housing Finance, Indiabulls Housing Finance, and Reliance Capital all enjoy an AAA-rating for their domestic long-term debt.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Apr 06 2016 | 10:50 PM IST