Jewellery sales on the rise as bullion price falls

Gold price declined more than 3% during the last week to trade at a six-month low of Rs 28,750 per 10g

)

Thanks to fall in bullion prices, jewellery sales have increased at least 20-25 per cent during the last one week, as buyers see limited potential for further fall from the current level.

Gold price declined more than three per cent during the last week to trade six-month low at Rs 28,750 per 10 gm in popular Zaveri Bazaar here on Saturday. The trend percolated to India from overseas markets, where investors sought refuge in other asset classes, including equities and currencies due to easing of geo-political tensions between Russia and Ukraine.

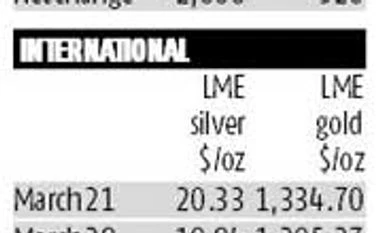

Spot gold in London fell 2.9 per cent over the week to close on Friday at $1,295.27 an oz. Both opportunistic and seasoned buyers found this price decline an opportunity, considering the present level as a realistic one.

In domestic jewellery retail stores, footfall has increased with a fillip in their buying enthusiasm. “We have seen at least 20 per cent increase in average daily jewellery sales in the last couple of days probably because of fall in gold prices. Most of opportunistic visitors have purchased some grammage of jewellery,” said Rajesh Mehta, chairman and managing director of Rajesh Exports, who operate 82 retail stores across India.

Silver also found many takers with its price witnessing 4.4 per cent decline over the week. Silver price fell to Rs 43,000 a kg here on Saturday following 2.40 per cent decline in global prices to $19.84 an oz.

“Our daily average sales have increased by 20-25 per cent in the last couple of days, as consumers believe further price fall impossible. Being alternative to gold, silver has been a preferred choice for investors and retail consumers both for store value and festival buying,” said Rahul Mehta, managing director of Silver Emporium in Mumbai.

Meanwhile, global advisory firms have lowered their gold price forecasts. While Goldman Sachs hints gold price to average lower this year at $1,050 an oz, Standard Chartered revises gold price forecasts eight per cent downwards to $1,225 an oz. According to CPM Group, gold averaged at $1,409.43 an oz in 2013, down 15.6 per cent from the average gold price of $1,670.15 an oz in 2012. This was the first annual average decline for the yellow metal in more than a decade. “Silver has very limited potential of further price fall. But, on a rebound, silver price will move up more rapidly than gold or any other metal in the group,” said Gnanasekar Thiagarajan, director, Commtrendz Research.

According to Bachhraj Bamalwa, a Kolkata-based jewellery retailer and former chairman of All India Gems & Jewellery Trade Federation, jewellery sales will see an upsurge next week. Because of financial year-end, many bulk consumers abstained from fresh purchases. They will come back again with huge orders next week, assuming the bullion price would remain at the current level, he added.

In India, appreciating rupee and falling spot premiums also contributed significantly to gold price fall. While Indian rupee appreciated 1.7 per cent over the week to close on Friday at 59.89 against the dollar, spot premiums fell to $ 40 an oz now from over $75 an oz a week ago.

Gold price declined more than three per cent during the last week to trade six-month low at Rs 28,750 per 10 gm in popular Zaveri Bazaar here on Saturday. The trend percolated to India from overseas markets, where investors sought refuge in other asset classes, including equities and currencies due to easing of geo-political tensions between Russia and Ukraine.

Spot gold in London fell 2.9 per cent over the week to close on Friday at $1,295.27 an oz. Both opportunistic and seasoned buyers found this price decline an opportunity, considering the present level as a realistic one.

Silver also found many takers with its price witnessing 4.4 per cent decline over the week. Silver price fell to Rs 43,000 a kg here on Saturday following 2.40 per cent decline in global prices to $19.84 an oz.

“Our daily average sales have increased by 20-25 per cent in the last couple of days, as consumers believe further price fall impossible. Being alternative to gold, silver has been a preferred choice for investors and retail consumers both for store value and festival buying,” said Rahul Mehta, managing director of Silver Emporium in Mumbai.

Meanwhile, global advisory firms have lowered their gold price forecasts. While Goldman Sachs hints gold price to average lower this year at $1,050 an oz, Standard Chartered revises gold price forecasts eight per cent downwards to $1,225 an oz. According to CPM Group, gold averaged at $1,409.43 an oz in 2013, down 15.6 per cent from the average gold price of $1,670.15 an oz in 2012. This was the first annual average decline for the yellow metal in more than a decade. “Silver has very limited potential of further price fall. But, on a rebound, silver price will move up more rapidly than gold or any other metal in the group,” said Gnanasekar Thiagarajan, director, Commtrendz Research.

According to Bachhraj Bamalwa, a Kolkata-based jewellery retailer and former chairman of All India Gems & Jewellery Trade Federation, jewellery sales will see an upsurge next week. Because of financial year-end, many bulk consumers abstained from fresh purchases. They will come back again with huge orders next week, assuming the bullion price would remain at the current level, he added.

In India, appreciating rupee and falling spot premiums also contributed significantly to gold price fall. While Indian rupee appreciated 1.7 per cent over the week to close on Friday at 59.89 against the dollar, spot premiums fell to $ 40 an oz now from over $75 an oz a week ago.

More From This Section

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Mar 29 2014 | 9:56 PM IST